NEW RESIDENTIAL DEVELOPMENT IN ALDERLEY (QLD) COMING IN 2024

Our national development partner network continues to source mid-scale specialty commercial, industrial and boutique residential projects across Australia, enabling Capital Prudential to “cherry pick” development opportunities with acceptable return metrics that further diversity the existing portfolio.

Most recently, Capital Prudential have secured a site in Alderley, Queensland with Development Approval to develop 50 bespoke apartments. Please see the FEATURED UPCOMING DEVELOPMENTS section below for further information. As always, Capital Prudential will use its own balance sheet to fund the pre-settlement expenses until the project satisfies our robust ‘de-risking’ process (e.g. meeting required levels of pre-sales) and is ready for settlement into the Capital Prudential Diversified Development Fund.

To support funding for this upcoming development in Alderley, we are offering eligible wholesale investors an interest rate of 10.00% p.a. paid quarterly for 5-month investments in our Secured Income Notes issued on or before 29 February 2024.

QUARTER ENDING DECEMBER 2023

We have continued our significant investment into both our national network of development managers with the appointment of Dejan Hancar (Assistant Development Manager), and our centralised team of governance, risk and funds management professionals with David Brewin (Head of Co-Living), and Jackson Greatrex (Manager Funding and Operations) joining our highly credentialed team this quarter. This continues to build our business capacity to source, managed and deliver mid-scale real estate developments within our disciplined risk management frameworks.

On the real estate development side this quarter, the “Jura” development project in Noosa met the requirements of our rigorous due diligence process and settled into the Capital Prudential Diversified Development Fund in November, strengthening the pool of secured assets for our investors. These boutique residential properties are now available for sale with construction set to commence in February. We also completed the sale of three detached dwellings at Walkerville.

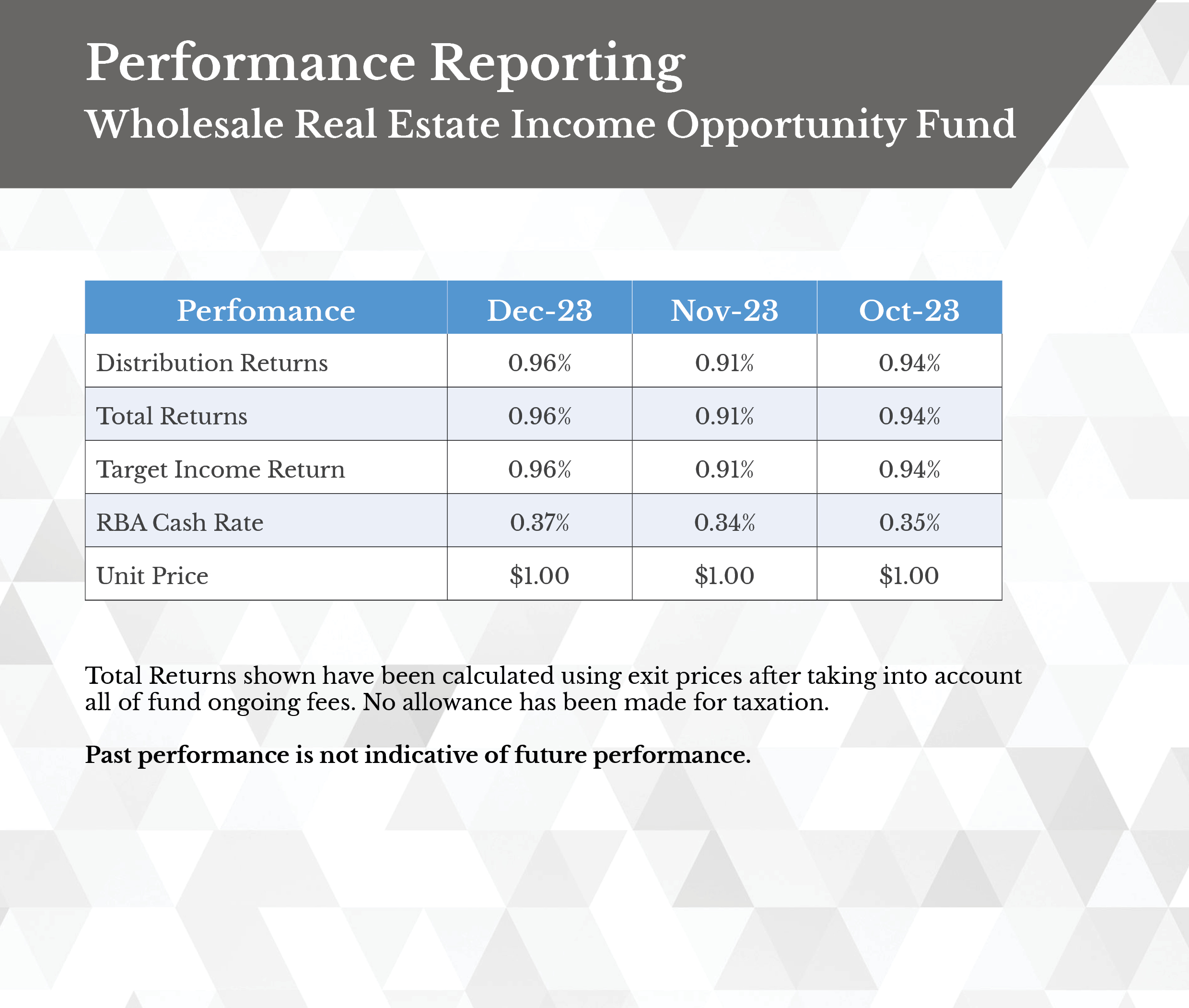

And on the capital side, we welcomed our first investors in the new Capital Prudential Wholesale Real Estate Income Opportunity Fund in December. The Income Opportunity Fund provides exposure to our Secured Income Notes program through units in an open-ended, Managed Investment Trust, targets a return RBA + 7.00% (currently 11.35%) paid monthly and is platform compatible.

Please contact us if you or your clients could benefit from predictable income returns via our Secured Income Notes or our units in our Income Opportunity Fund.

Thank you to all our investors for your ongoing support.

Sam Moore

Managing Director

M: 0400 285 405

TEAM UPDATES

David Brewin

– Head of Co-Living

David is a property and funds management specialist with 30 years of experience across various real estate activities.

Having previously worked with major Australian REITS such as Dexus, Westfield and Mirvac spanning strategic, financial and investor relations roles, David has developed a deep knowledge of all facets of property development, operations and transactions.

Most recently, David was General Manager, Funds Management for Daniel Grollo Group’s residential build-to-rent joint venture, Home.

Jackson Greatrex

– Manager, Funding & Operations

Jackson is a passionate business and finance professional, with a broad range of skills spanning across banking and business administration.

He brings experience in complex lending structuring, financial analysis and reporting, project management and property funding.

Mostly recently, Jackson was a Senior Associate, Business Banking at NAB, specialising in commercial lending to property investors and developers, building and constructions companies and to the transport and logistics industry.

Dejan Hancar

– Assistant Development Manager

Dejan is a passionate property professional with extensive experience in both property valuation and commercial development.

Having worked for leading international analytic company, CoreLogic, and property valuation company, Opteon, Dejan has gained an immense skillset and deep understanding of various real estate activities.

Most recently, Dejan worked for a private development company specialising in acquiring and delivering a broad range of commercial-based assets.

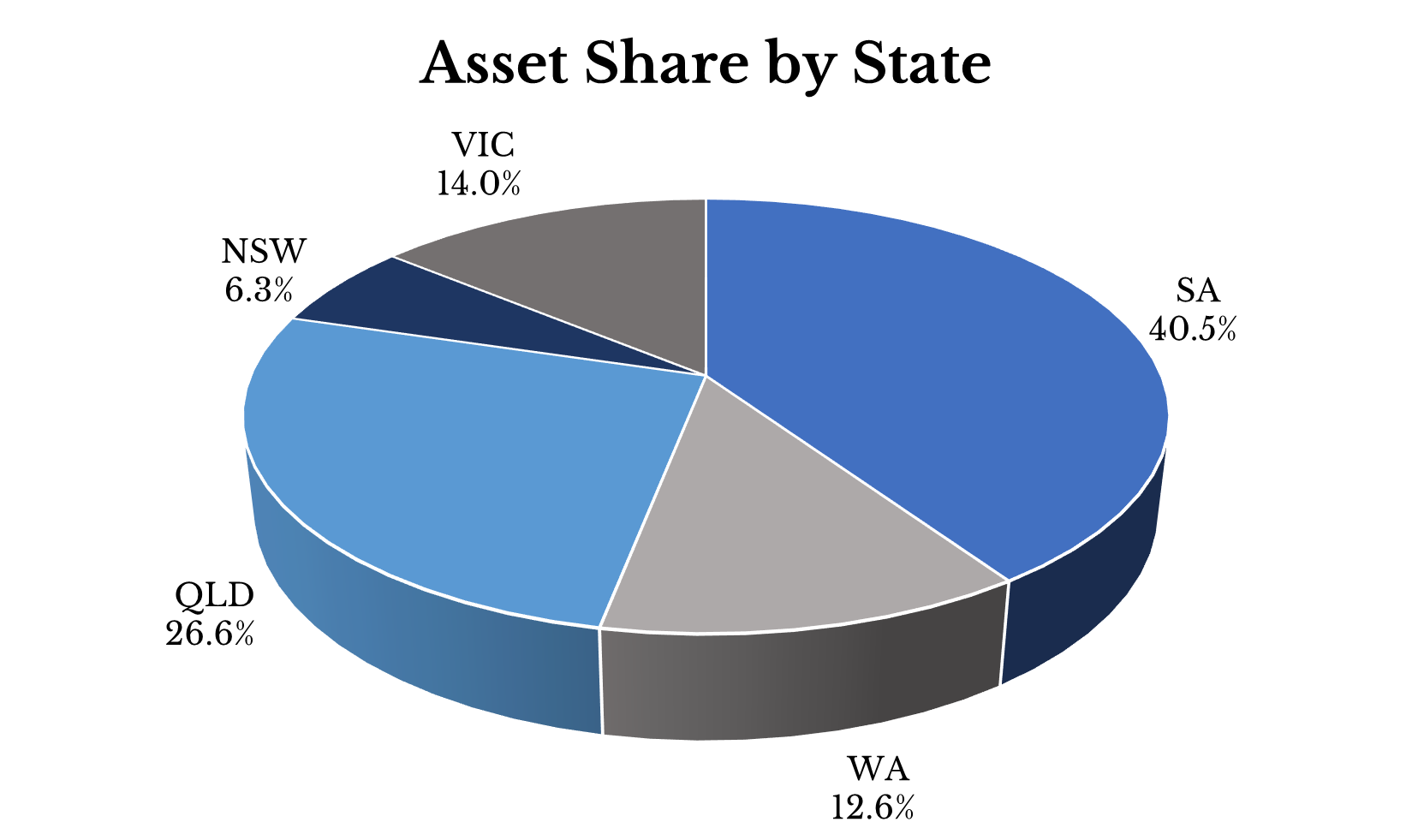

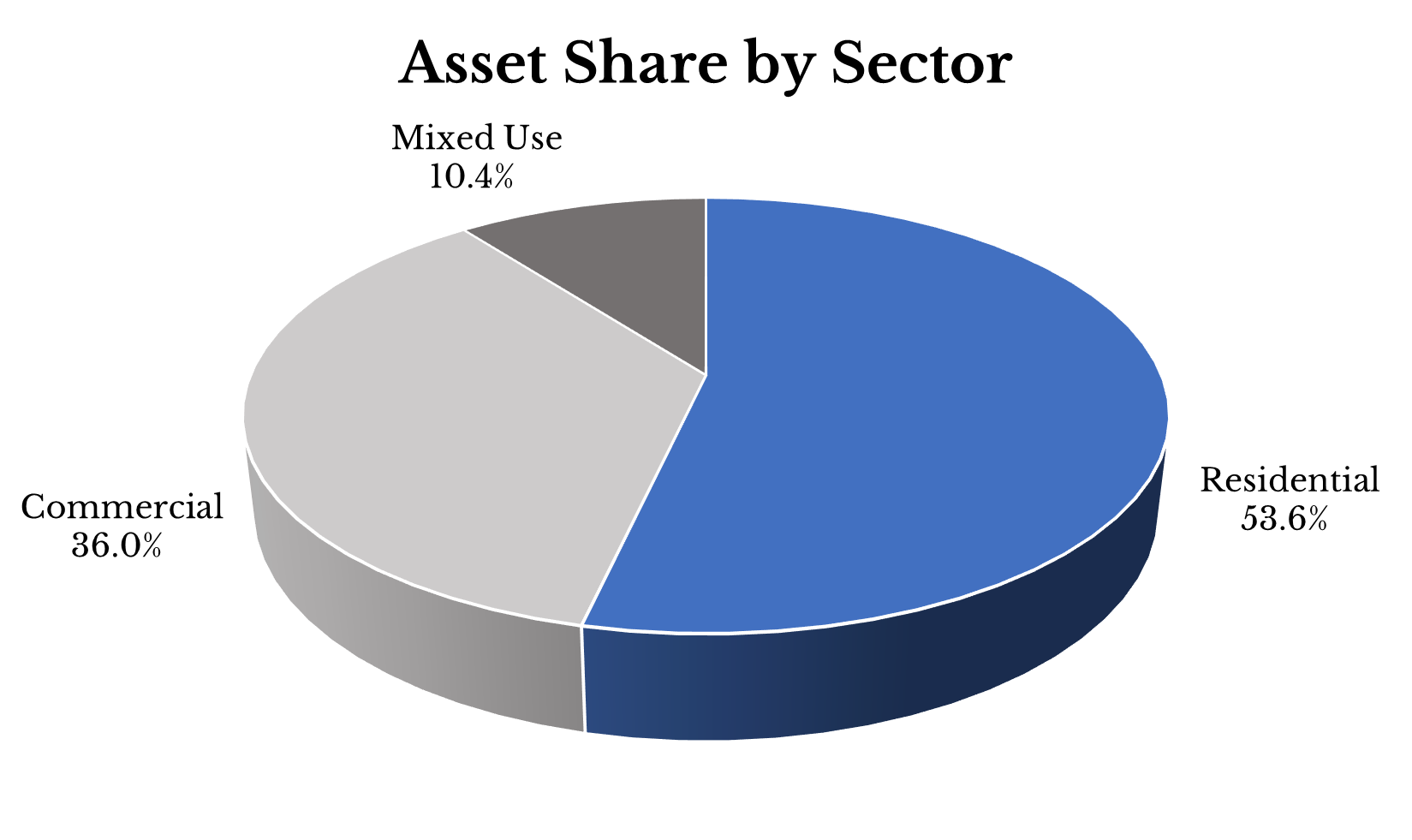

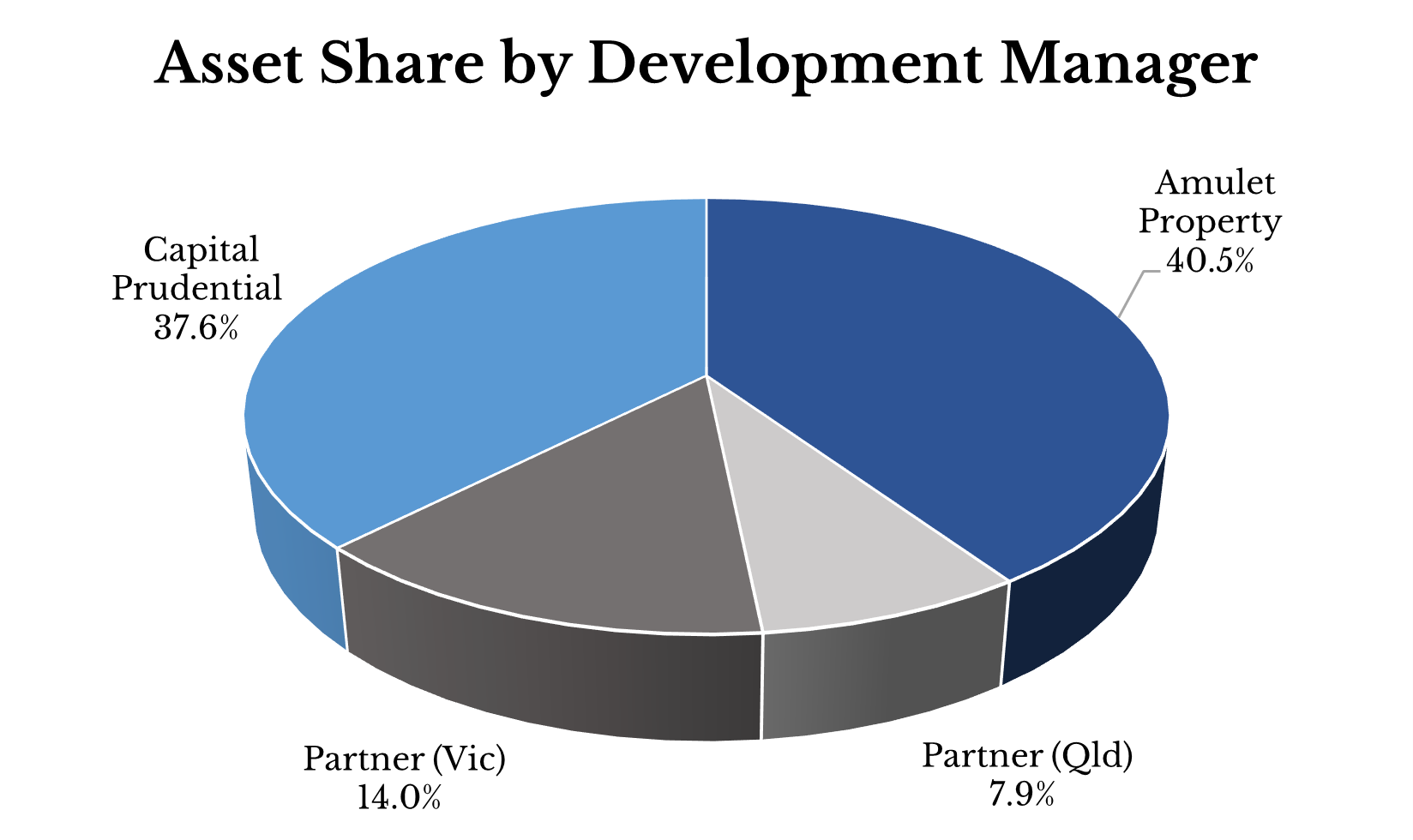

The graphs below illustrate the diversification of the property development assets wholly or majority owned by the Capital Prudential Diversified Development Fund as at 31 December 2023.

DISCLAIMER: This information has been prepared and issued by Capital Prudential Funds Management Pty Ltd (ABN 83 636 279 082/AFSL 524725) (CPFM) and is intended for use only by wholesale clients pursuant to section 761G(7) or 761GA of the Corporations Act 2001 (Cth). This information is not intended for any person who is a retail client within the meaning of section 761G or 761GA of the Corporations Act 2001 (Cth).

Capital Prudential Diversified Development Fund Pty Ltd ACN 636 282 219 (CPDDF) is the trustee of, and issuer of securities in, the Capital Prudential Diversified Development Fund. The Trust Company (RE Services) Limited ACN 003 278 831, AFSL 235 150 (TTCRESL) is the trustee and issuer of units in the Capital Prudential Real Estate Master Trust. Perpetual Trust Services Limited (ACN 000 142049; AFSL 236 648) (PTSL) is the responsible entity and the issuer of units in the Capital Prudential Retail Real Estate Master Trust. Capital Prudential Manager Pty Ltd ACN 660 087 847 (authorised representative of CPFM) (Investment Manager) is the investment manager of the Capital Prudential Real Estate Master Trust and Capital Prudential Retail Real Estate Master Trust.

This information is general only and is not personal advice. It has been prepared without taking into account your objectives, financial situation or needs. If you require financial advice that takes into account your personal objectives, financial situation or needs, consult your financial adviser. You should consider the relevant Information Memorandum, Product Disclosure Statement and Target Market Determination available by visiting our website https://capitalprudential.com.au/, prior to making any investment decisions.

Neither the Investment Manager, CPDDF, CPFM, TTCRESL, PTSL, their employees or directors, or any of their related parties (including Perpetual Limited ABN 86 000 431 827 and its subsidiaries) provide any warranty of accuracy, completeness or reliability in relation to the information contained herein or accept any liability to any person who relies on it.

This information is current only as at the date indicated and may be superseded by subsequent market events or for other reasons. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. All investments contain risk and may lose value.

The rating contained in this document is issued by SQM Research Pty Ltd ABN 93 122 592 036 AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.

*The interest rates for a particular offer may differ from the interest rate for any Secured Income Notes previously or subsequently offered and issued. The interest rate for each Secured Income Note will be the rate notified in writing when offered to the Investor prior to their investment.