SECURED INCOME NOTES 12.00% P.A. FIXED INTEREST FOR 3 YEARS

With consensus amongst economists that interest rates have reached their peak, the question is when are rate cuts likely to occur? Looking at the bond market, traders have priced out rate relief until early 2025, citing the inflationary pressure of income tax cuts and the Australian economy lagging approximately six months behind tightening in the US cycle. On the other hand, many market commentators are predicting rate cuts in late 2024 given the nation’s slowdown in economic growth; Jamieson Coote Bonds, for example, are forecasting a divergence from the US Federal Reserve as early as August on the basis that population growth is the only factor keeping Australia out of recession.

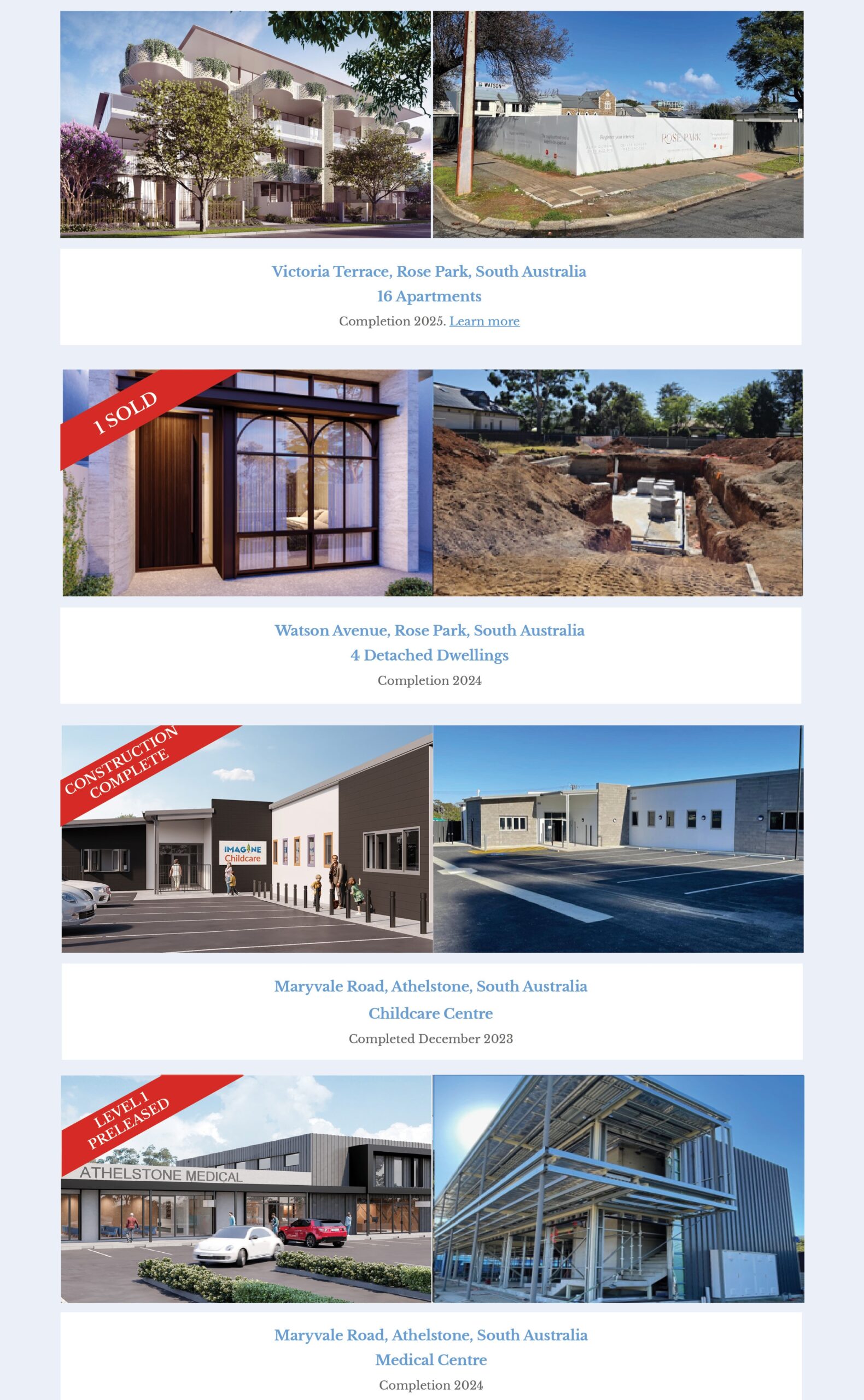

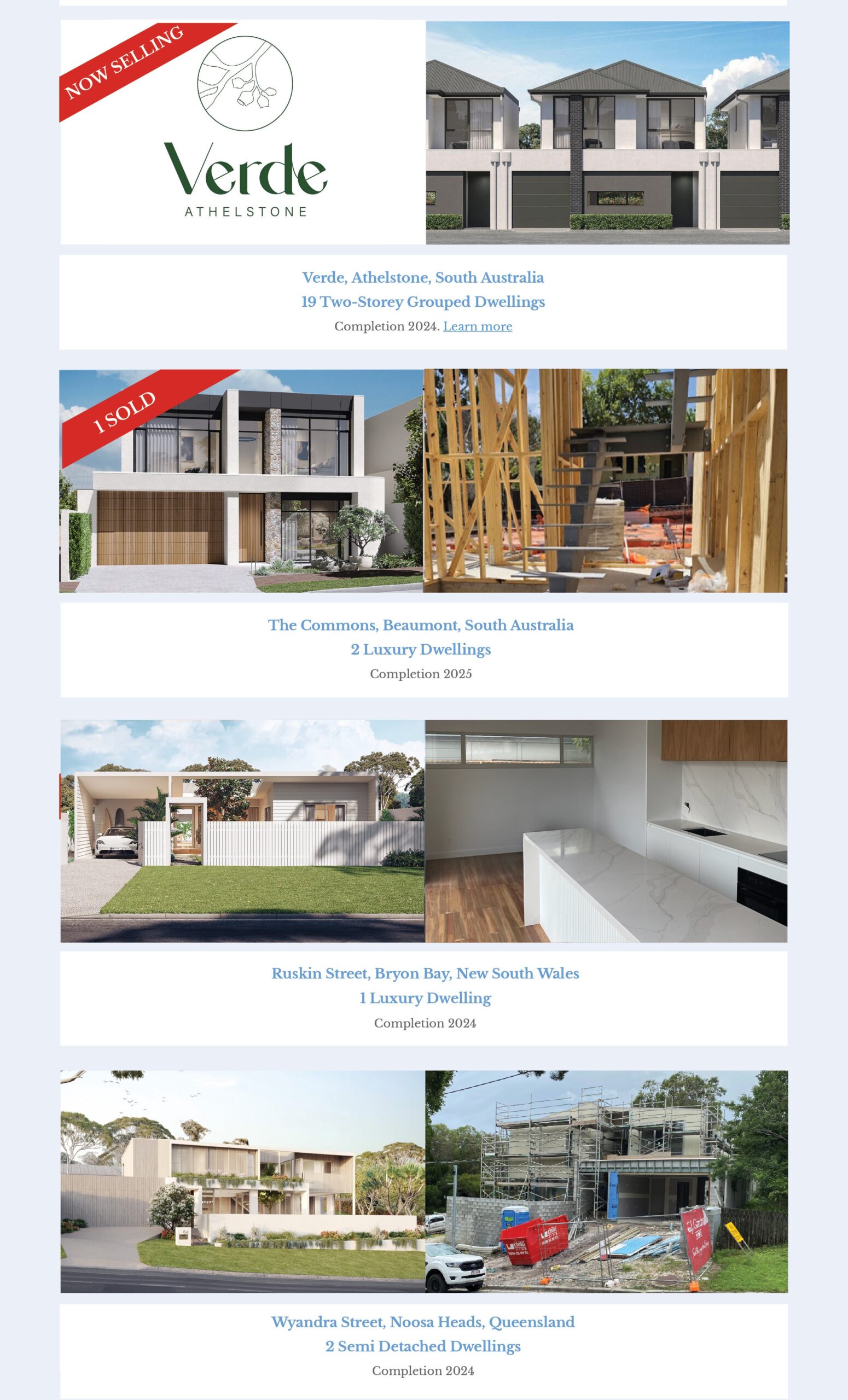

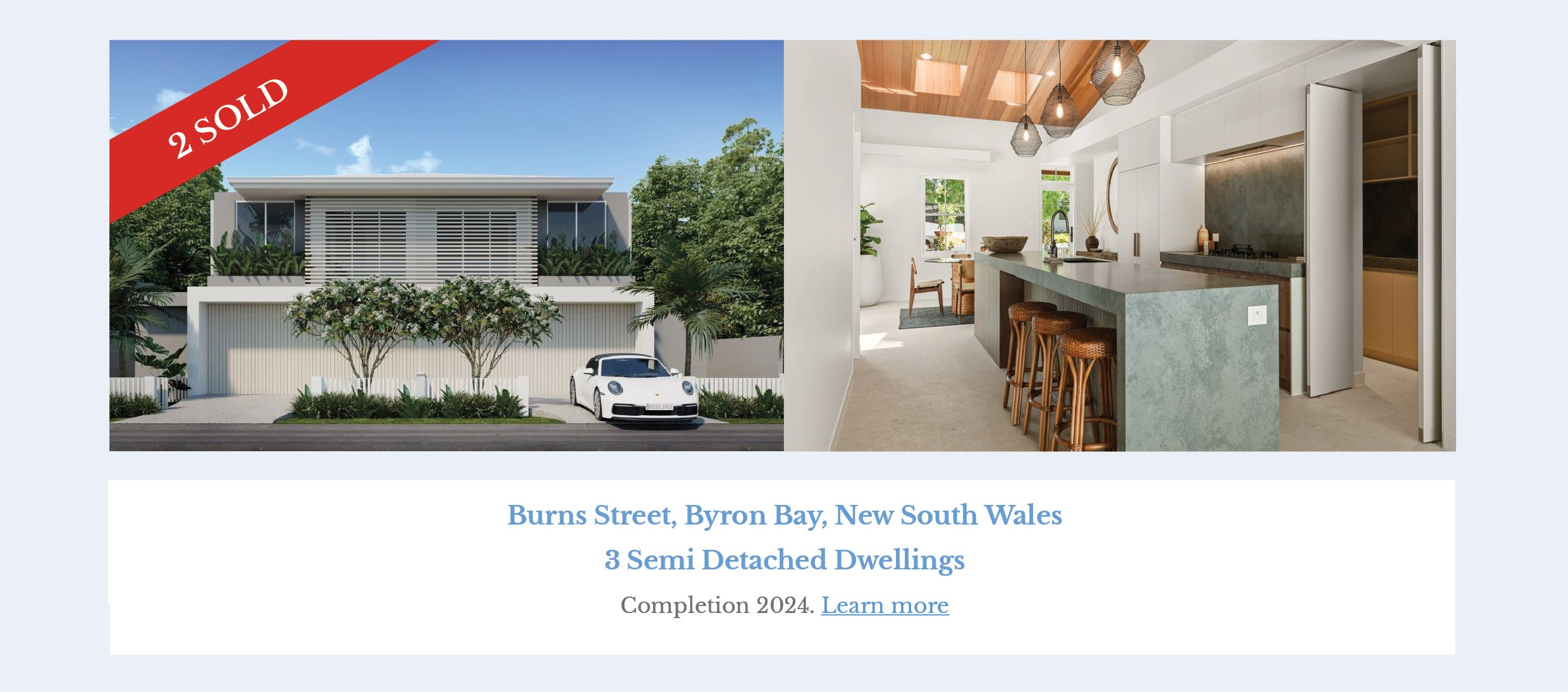

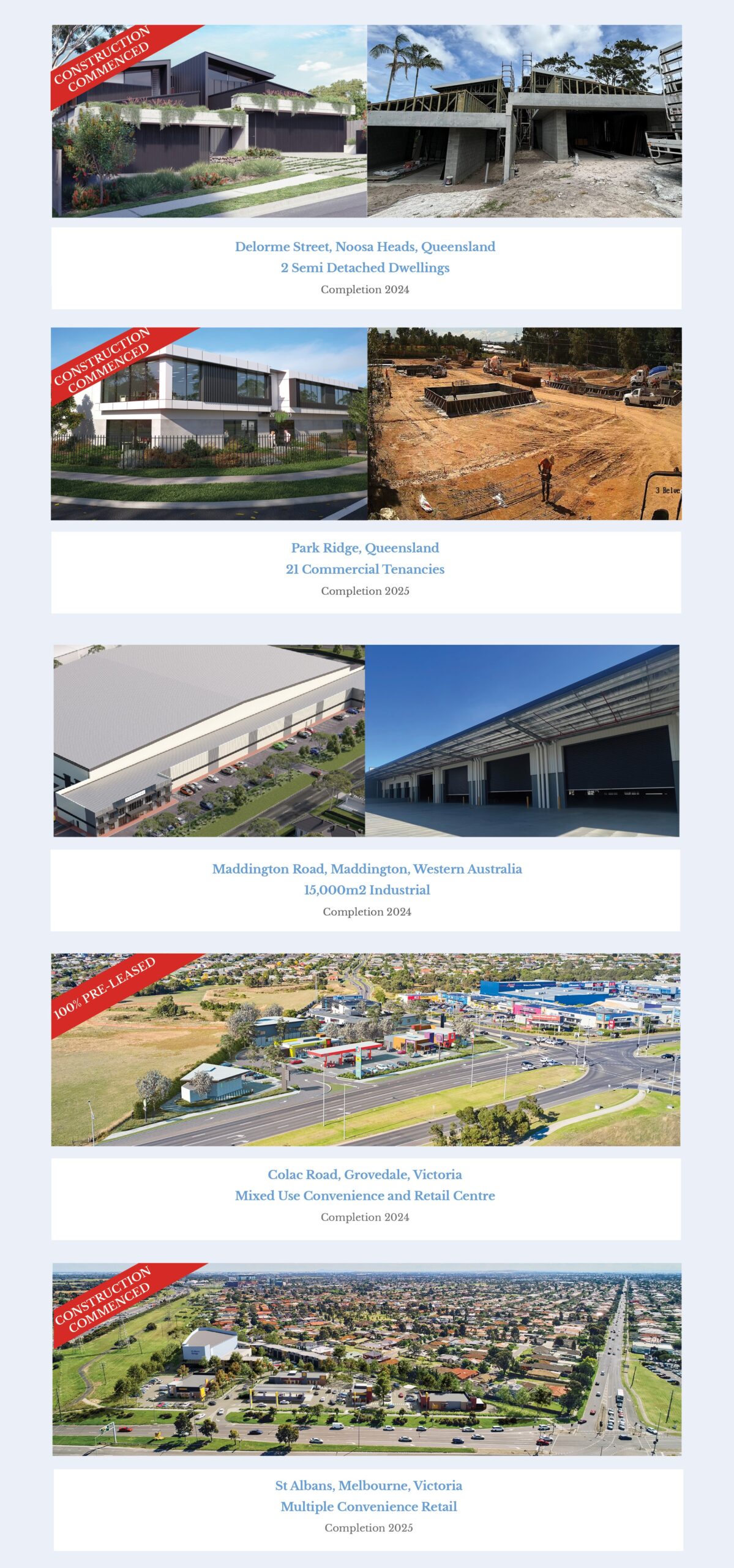

Despite the high rate environment, residential property prices continue to hold driven by shortages in the Australian housing supply that are predicted to become even more acute over the short term, presenting opportunities for the CPDDF throughout 2024 . The industrial market, which saw significant growth over the last two years, has strong fundamentals with rents and yields expected to remain steady throughout 2024.

Led by Clancy Sprouster, our new General Manager – CPDDF, we continue to be inundated with attractive development opportunities from our national development manager network. Our St Albans (VIC) site settled into the Diversified Development Fund in February and we are excited to see construction has already commenced. Our bespoke apartment project, Breathe Apartments in Alderley (QLD) launched this month with high levels of enquiry. And most recently, the Diversified Development Fund has secured an industrial opportunity in Wacol (QLD) brought to us by Norhart Developments, further contributing to diversification of the pool across origination, location and property type metrics.

With such a strong development pipeline, the Diversified Development Fund is currently providing wholesale investors the opportunity to lock in Secured Income Notes at fixed interest rates (e.g. 2 year 11.00% p.a. or 3 year 12.00% p.a.) maturing well past consensus rate cut forecasts.1

Our continued investment in governance and business enablement continues to be a point of focus. We announced the appointment of Brenton Mauriello (AM) as a Non-Executive Director to the Board of Capital Prudential Pty Ltd in January, the Diversified Development Fund retained its Favourable 3.75 Star Rating from SQM Research and very recently, Deloitte assessed our operational controls framework and awarded Capital Prudential Manager with GS007 Type 1 Assurance for Investment Management Services.2

Furthermore, we are excited to announce our Income Opportunity Fund, targeting a monthly return of RBA + 7.00%, is now available for financial advisers to access on the DASH Investment Platform.3

Please reach out if you or your clients could benefit from attractive, predictable income returns.

Thank you to all our investors, suppliers and partners for your invaluable support.

Sam Moore

Managing Director

M: 0400 285 405

TEAM UPDATES

We are pleased to formally welcome Clancy Sprouster as General Manager, CPDDF Property and Brenton Mauriello (AM) as Non-Executive Director – Capital Prudential Pty Ltd who joined our highly credentialed team in January 2024.

Clancy Sprouster

– General Manager, CPDDF Property

Clancy is a highly experienced development professional having worked across both ASX listed institutional and private development companies throughout his career, working closely with their design, construction, sales and marketing teams. Clancy’s experience covers mixed-use and residential projects including large scale multi-stage developments (up to $750m of value) and covers the full breadth of the development life cycle.

Clancy prides himself on building high performance teams and motivating them to deliver the best outcomes for the business and projects they work on.

Brenton Mauriello (AM)

– Non-Executive Director, Capital Prudential Pty Ltd

Brenton is a highly accomplished property development professional and experienced board director with executive management experience spanning construction, architecture, automotive, pharmaceuticals and distribution.

Awarded membership of the Order of Australia (AM) for services to the Australia-Thailand and Australia-ASEAN relationship, Brenton has been Executive Chairman of DWP (Design Worldwide Partnership) an integrated design company with 350 staff providing architectural and interior design solutions across Asia, India and the Middle East since 2004. Brenton is also Director and CEO of Raimon Land PLC, a Thailand based luxury property development company listed on the SET (Stock Exchange of Thailand).

Brenton is a fellow and part time facilitator at the Institute of Directors of Thailand, current Treasurer and past President of the Australia-ASEAN Chamber of Commerce as well as Chairman of The Advance Australia Council (Thailand) and The Australian Football League (AFL) Thailand.

Previously, Brenton held the positions of Director of the Board of Trade Thailand, President and Vice President of the Australian–Thailand Chamber of Commerce and President of the South Australia Club Thailand.

Brenton is currently undertaking a Doctorate of Business in Corporate Governance with the Australian Institute of Business, and is a graduate of the University of South Australia (B.ed Sc.) and obtained his MBA from the University of Singapore.

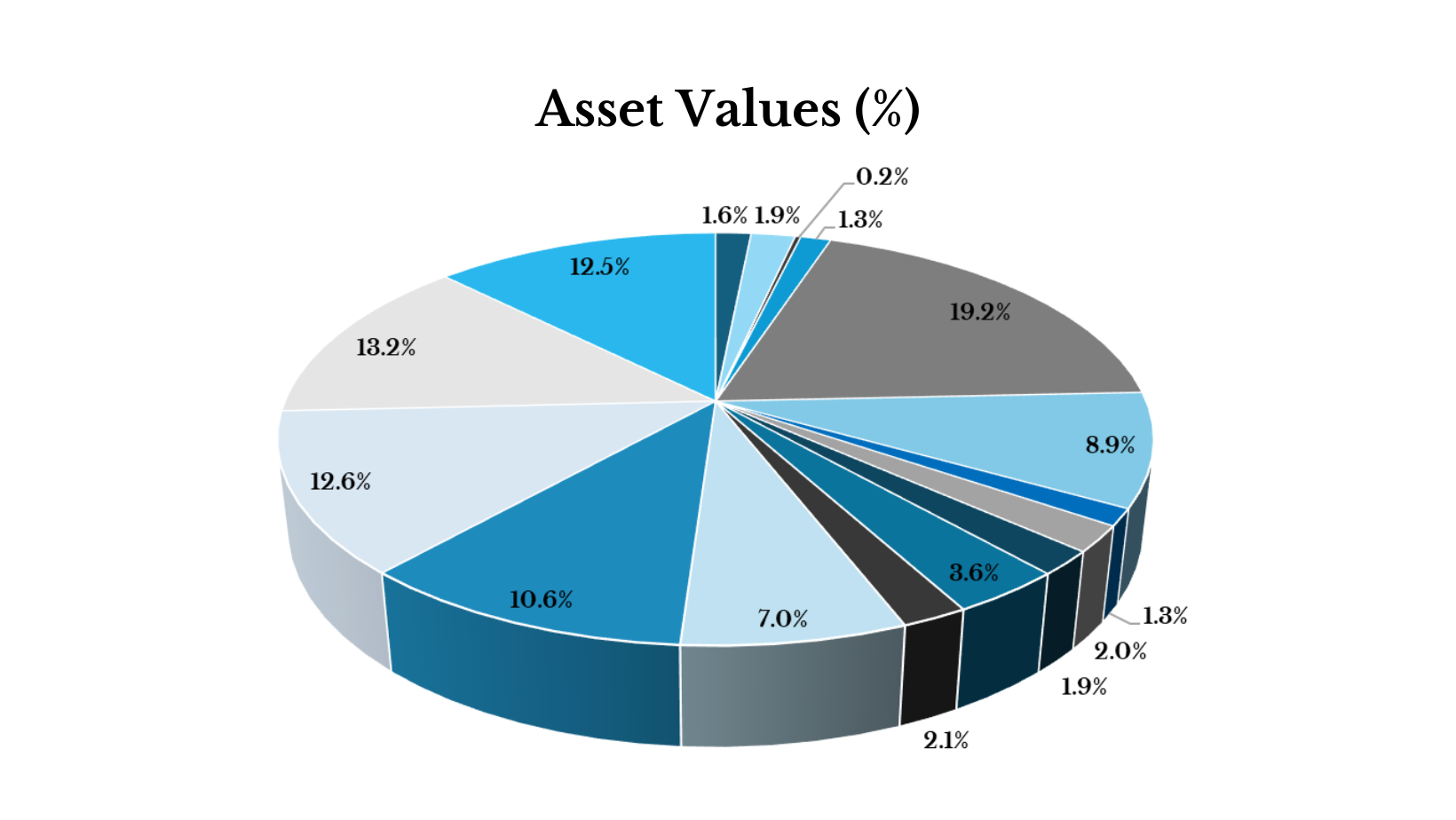

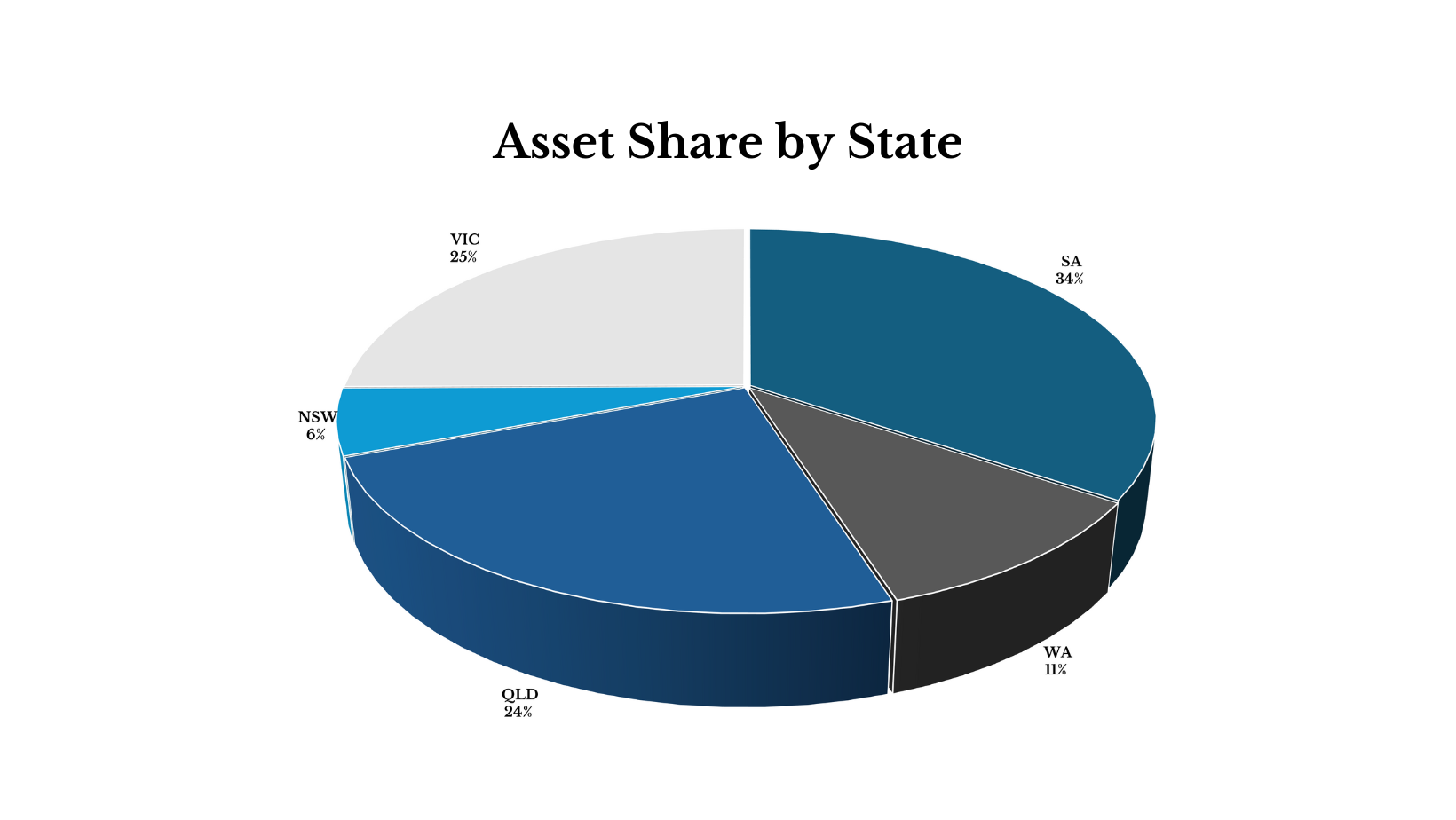

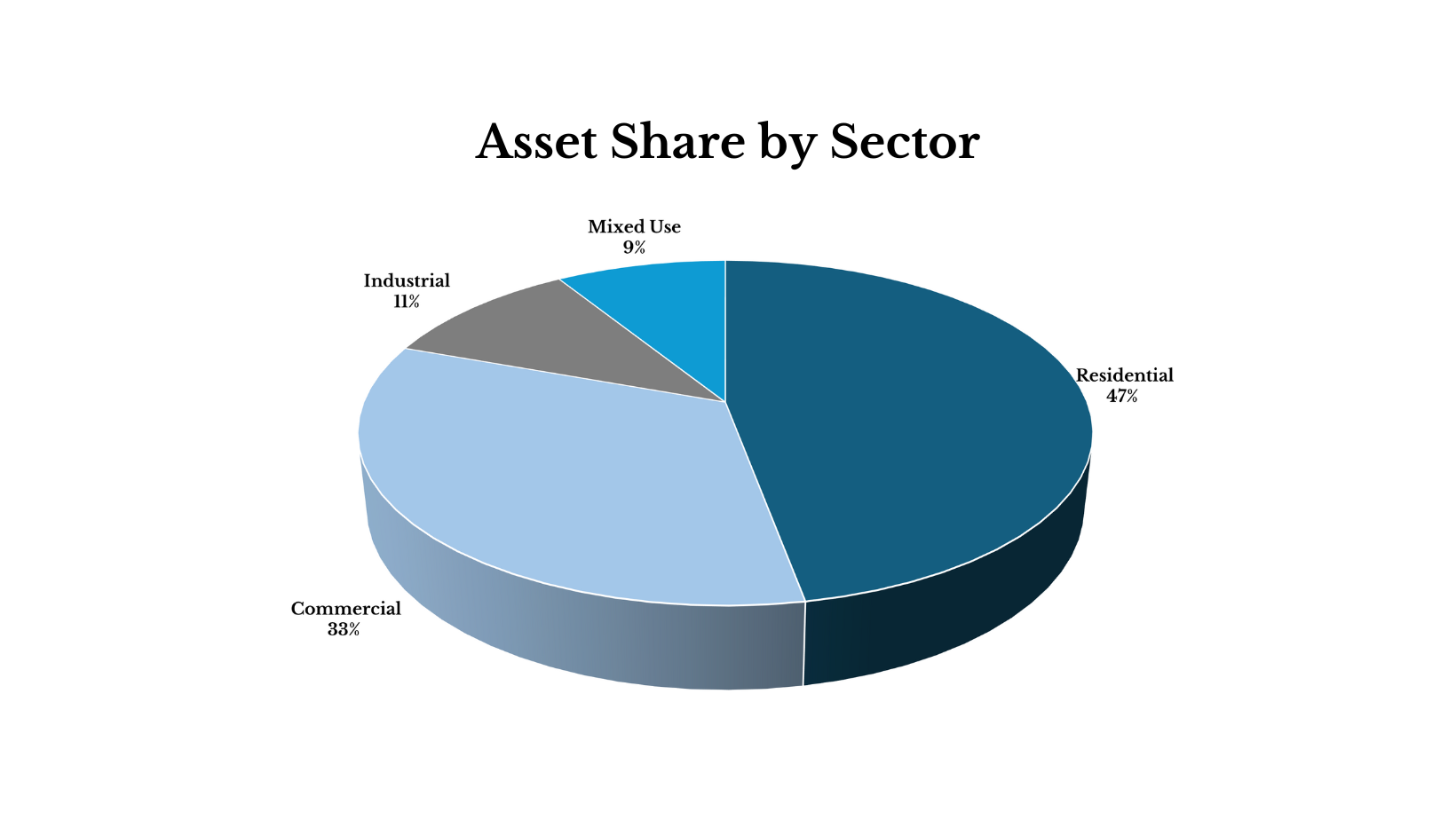

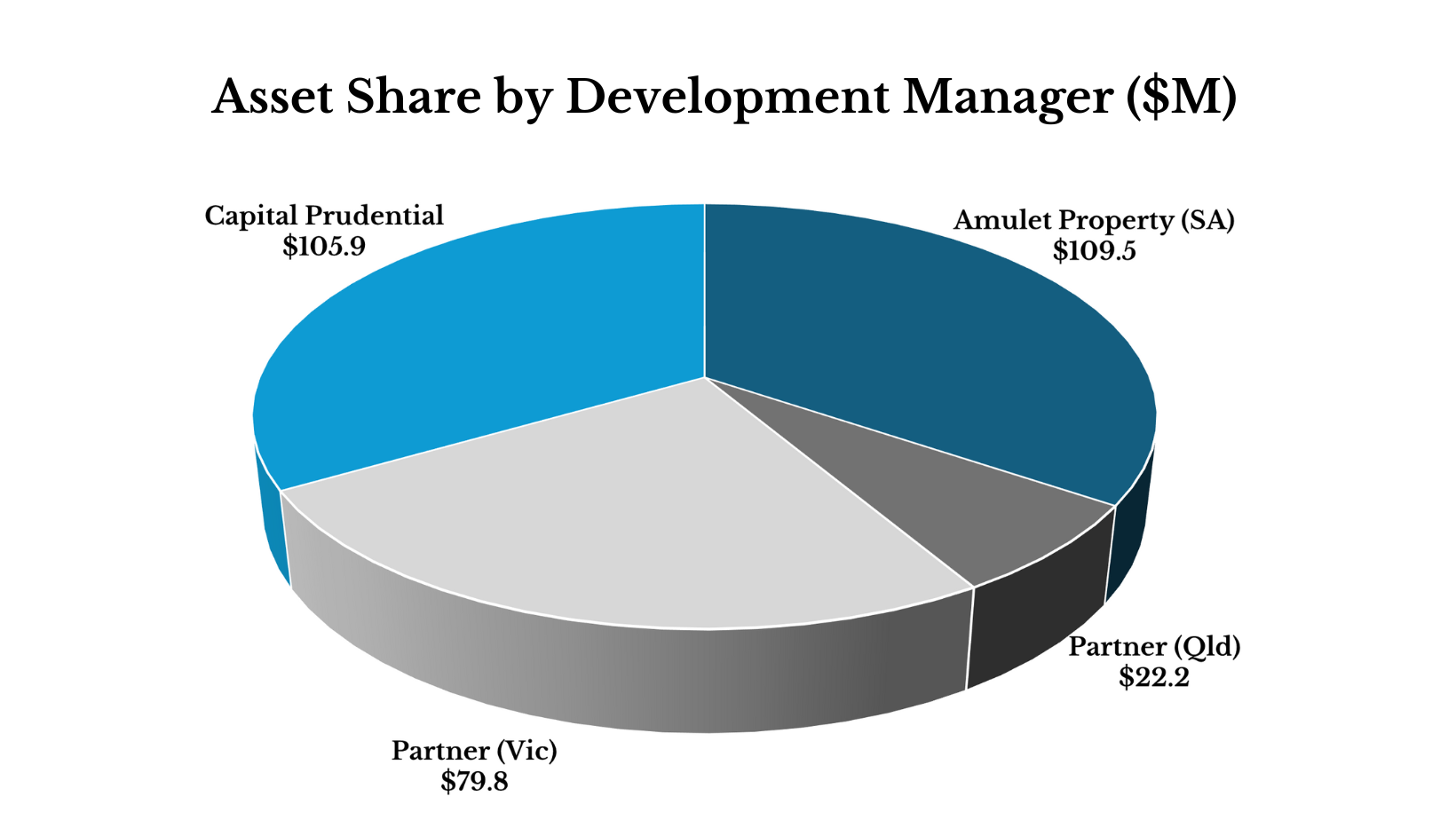

The graphs below illustrate the diversification of the property development assets wholly or majority owned by the Capital Prudential Diversified Development Fund as at 31 March 2024.

We are excited to announce our Income Opportunity Fund is now available for financial advisers to access on the DASH Investment Platform.

Targeting a monthly return of RBA + 7.00% (currently 11.35%), the Income Opportunity Fund offers wholesale clients exposure to the Capital Prudential Diversified Development Fund through a unitised structure.3

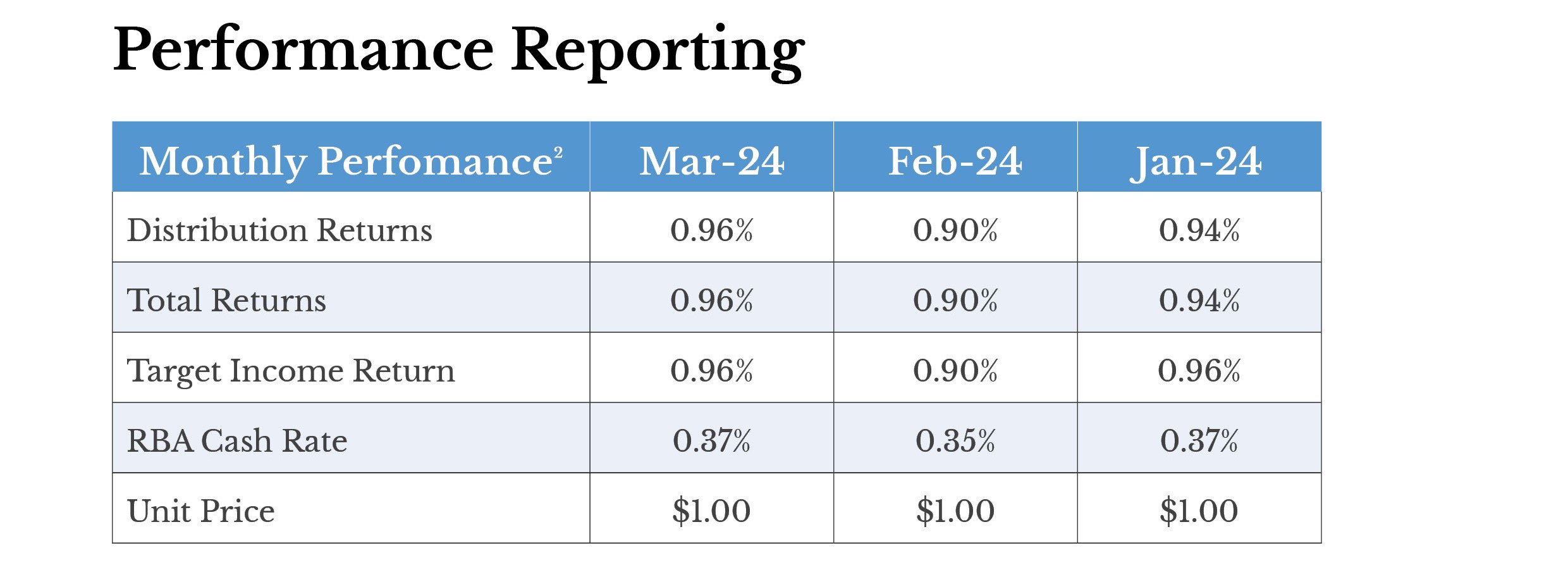

2 Total Returns shown have been calculated using exit prices after taking into account all of fund ongoing fees. No allowance has been made for taxation. Past performance is not indicative of future performance.

DISCLAIMER: This information has been prepared and issued by Capital Prudential Funds Management Pty Ltd (ABN 83 636 279 082/AFSL 524725) (CPFM) and is intended for use only by wholesale clients pursuant to section 761G(7) or 761GA of the Corporations Act 2001 (Cth). This information is not intended for any person who is a retail client within the meaning of section 761G or 761GA of the Corporations Act 2001 (Cth).

Capital Prudential Diversified Development Fund Pty Ltd ACN 636 282 219 (CPDDF) is the trustee of, and issuer of securities in, the Capital Prudential Diversified Development Fund. The Trust Company (RE Services) Limited ACN 003 278 831, AFSL 235 150 (TTCRESL) is the trustee and issuer of units in the Capital Prudential Real Estate Master Trust. Perpetual Trust Services Limited (ACN 000 142049; AFSL 236 648) (PTSL) is the responsible entity and the issuer of units in the Capital Prudential Retail Real Estate Master Trust. Capital Prudential Manager Pty Ltd ACN 660 087 847 (authorised representative of CPFM) (Investment Manager) is the investment manager of the Capital Prudential Real Estate Master Trust and Capital Prudential Retail Real Estate Master Trust.

This information is general only and is not personal advice. It has been prepared without taking into account your objectives, financial situation or needs. If you require financial advice that takes into account your personal objectives, financial situation or needs, consult your financial adviser. You should consider the relevant Information Memorandum, Product Disclosure Statement and Target Market Determination available by visiting our website https://capitalprudential.com.au/, prior to making any investment decisions.

Neither the Investment Manager, CPDDF, CPFM, TTCRESL, PTSL, their employees or directors, or any of their related parties (including Perpetual Limited ABN 86 000 431 827 and its subsidiaries) provide any warranty of accuracy, completeness or reliability in relation to the information contained herein or accept any liability to any person who relies on it.

Any opinions, forecasts, estimates or projections reflect judgments of the Investment Manager as at the date of this publication and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct. Actual returns could differ significantly from any forecasts, estimates or projections provided. Past performance is not a reliable indicator of future performance.

This information is current only as at the date indicated and may be superseded by subsequent market events or for other reasons. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. All investments contain risk and may lose value.

1 The interest rates for a particular offer may differ from the interest rate for any Secured Income Notes previously or subsequently offered and issued. The interest rate for each Secured Income Note will be the rate notified in writing when offered to the Investor prior to their investment.

2 The rating contained in this document is issued by SQM Research Pty Ltd ABN 93 122 592 036 AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.

3 This is a target only, the Fund may not achieve this return.