CAPITAL PRUDENTIAL HITS HALF A BILLION DOLLAR MILESTONE

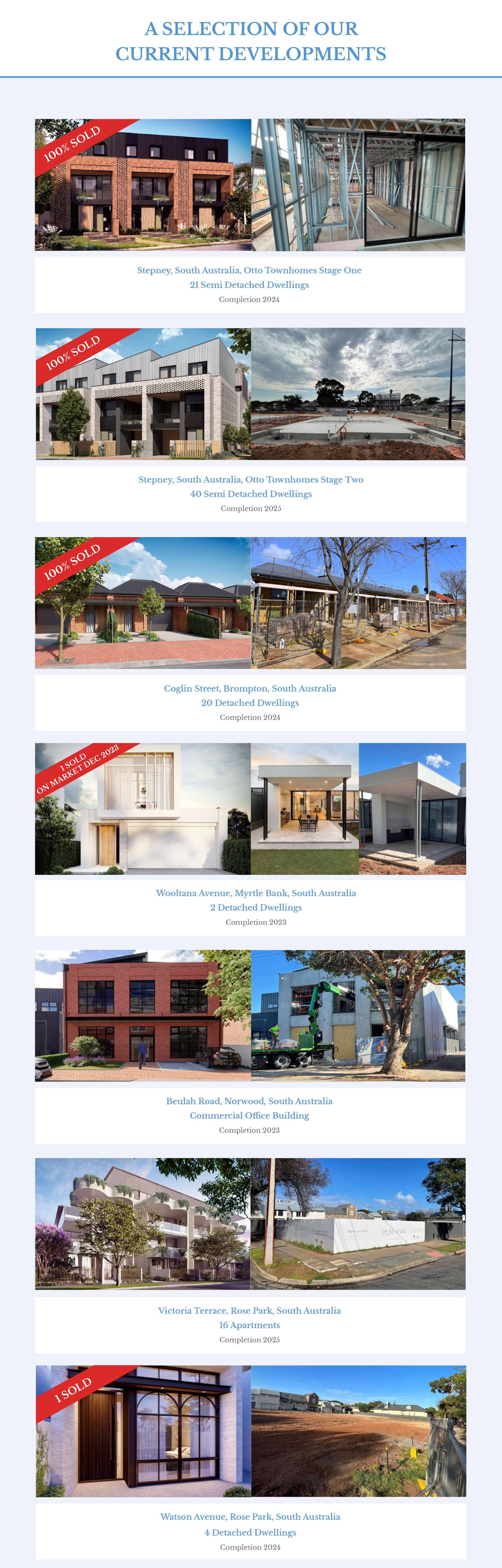

From developing our first residential homes in December 2020, we are excited to report that Capital Prudential has now reached $500 million in completed, in-progress and pipeline developments across Australia. This remarkable milestone reflects the commitment of our highly credentialed team to generating attractive, predictable returns through Capital Prudential’s unique and disciplined approach to property development.

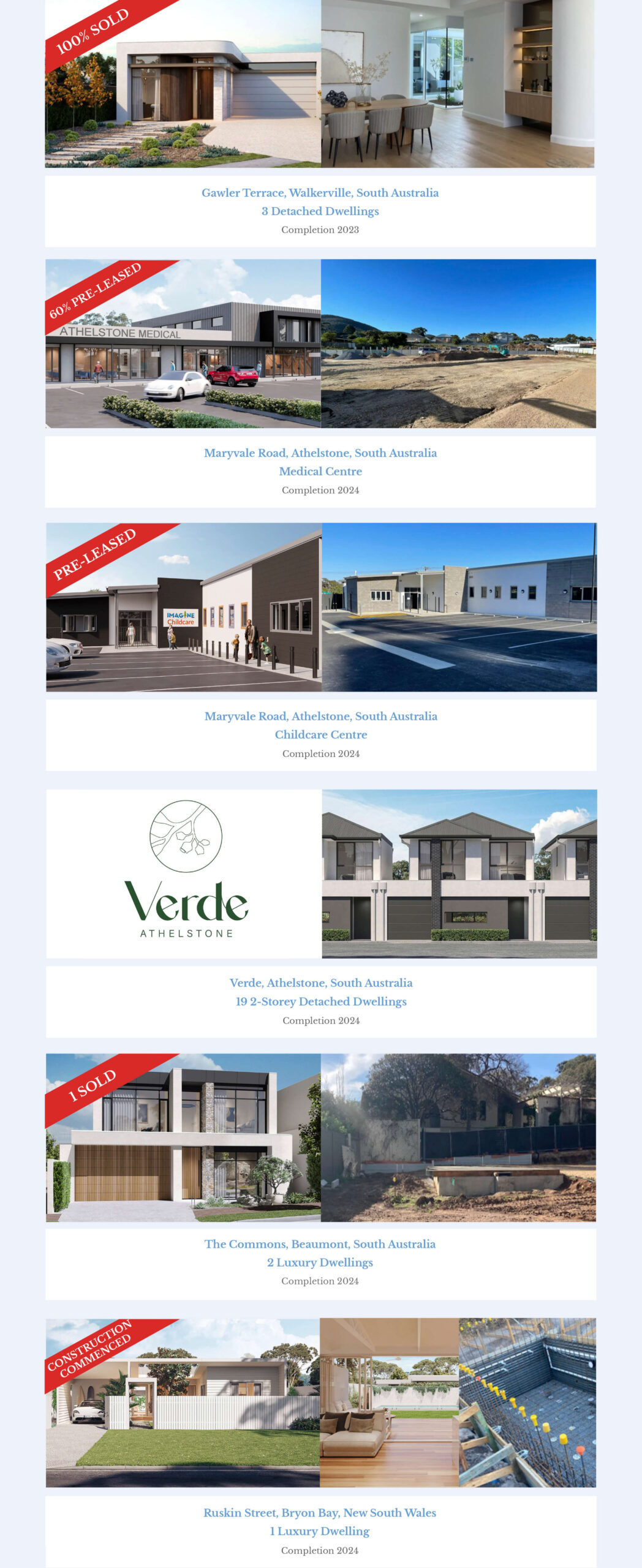

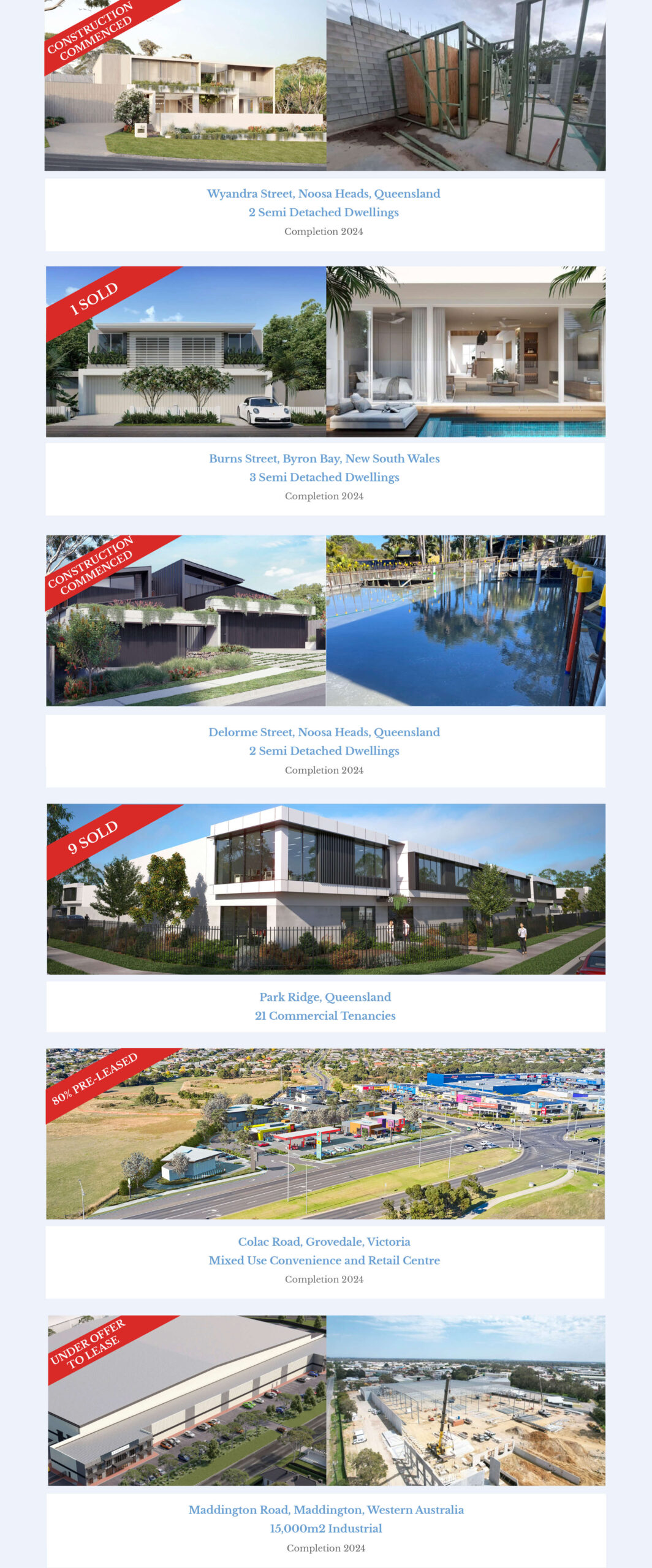

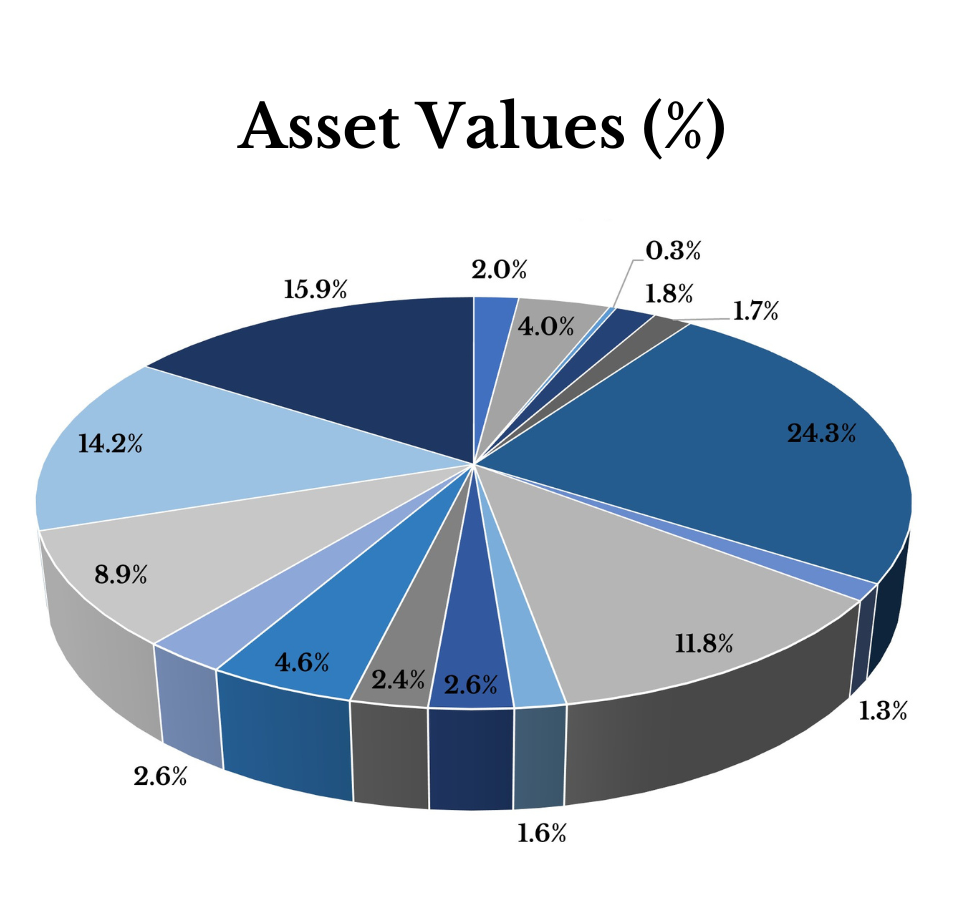

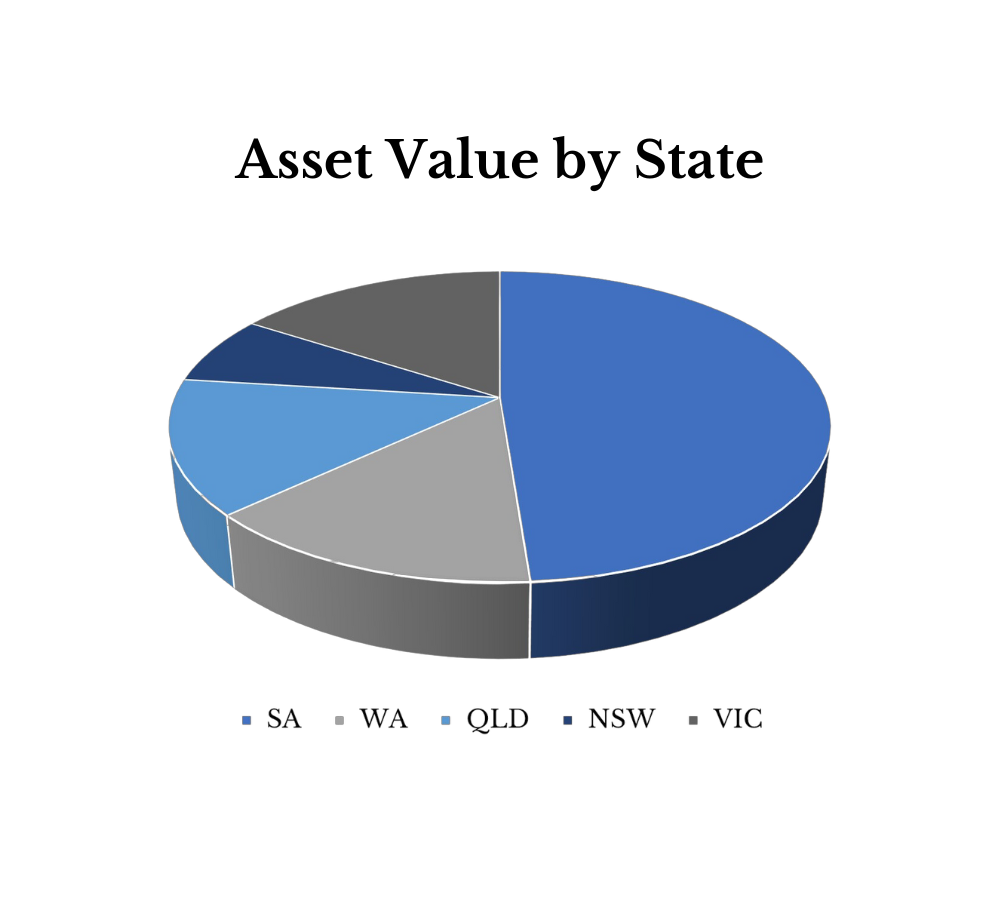

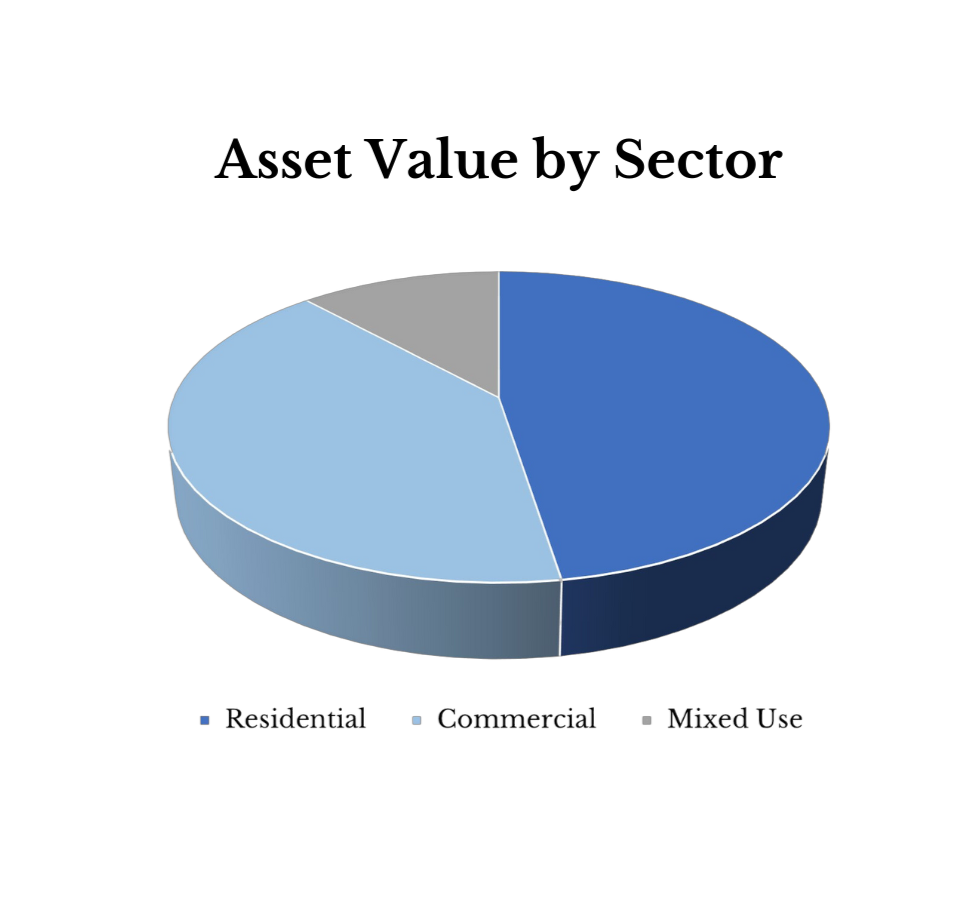

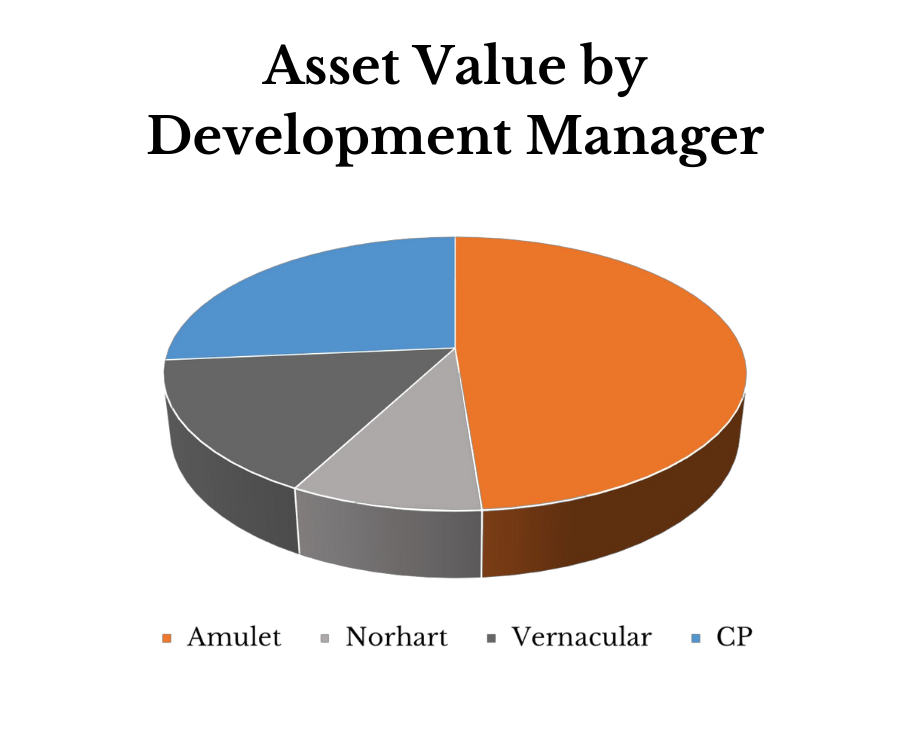

Please refer to the DEVELOPMENT UPDATES and PORTFOLIO DIVERSIFICATION sections below, illustrating the diversification of our developments by state, development manager, and sector.

With the RBA holding interest rates steady four months in a row, we have observed the heat coming off markets in the eastern states. This has greatly enhanced our ability to assess opportunities against our proprietary feasibility model and acquire sites on more favourable terms – longer settlement periods and conditional contract terms are requirements of our model as each property development must pass our rigorous de-risking process before settlement.

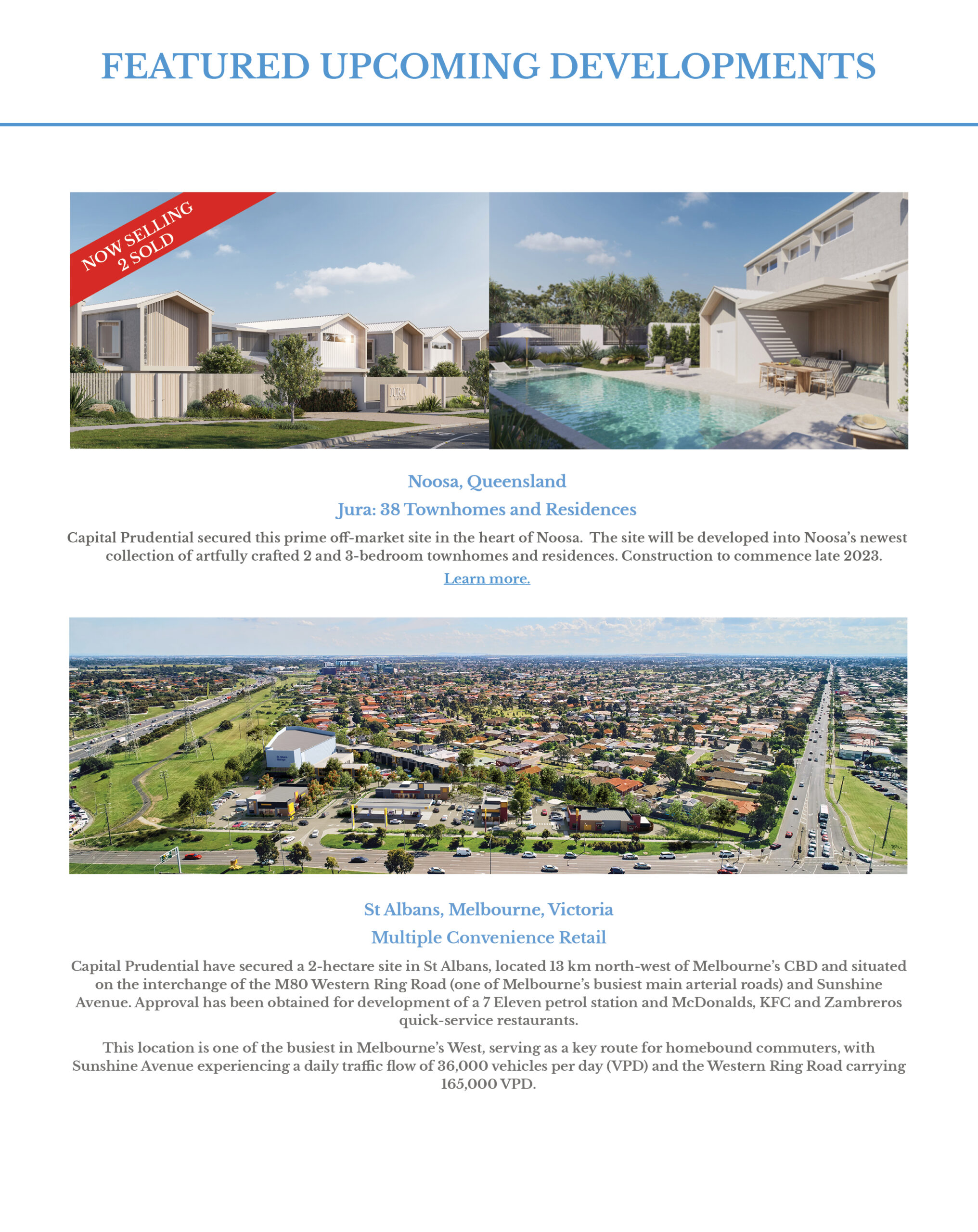

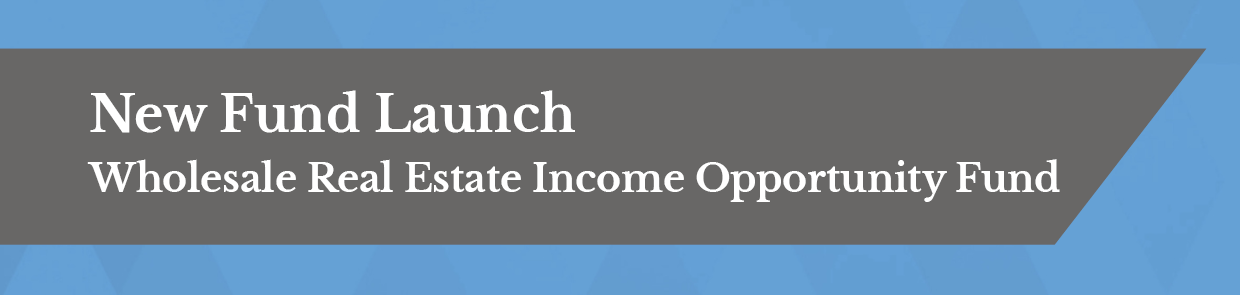

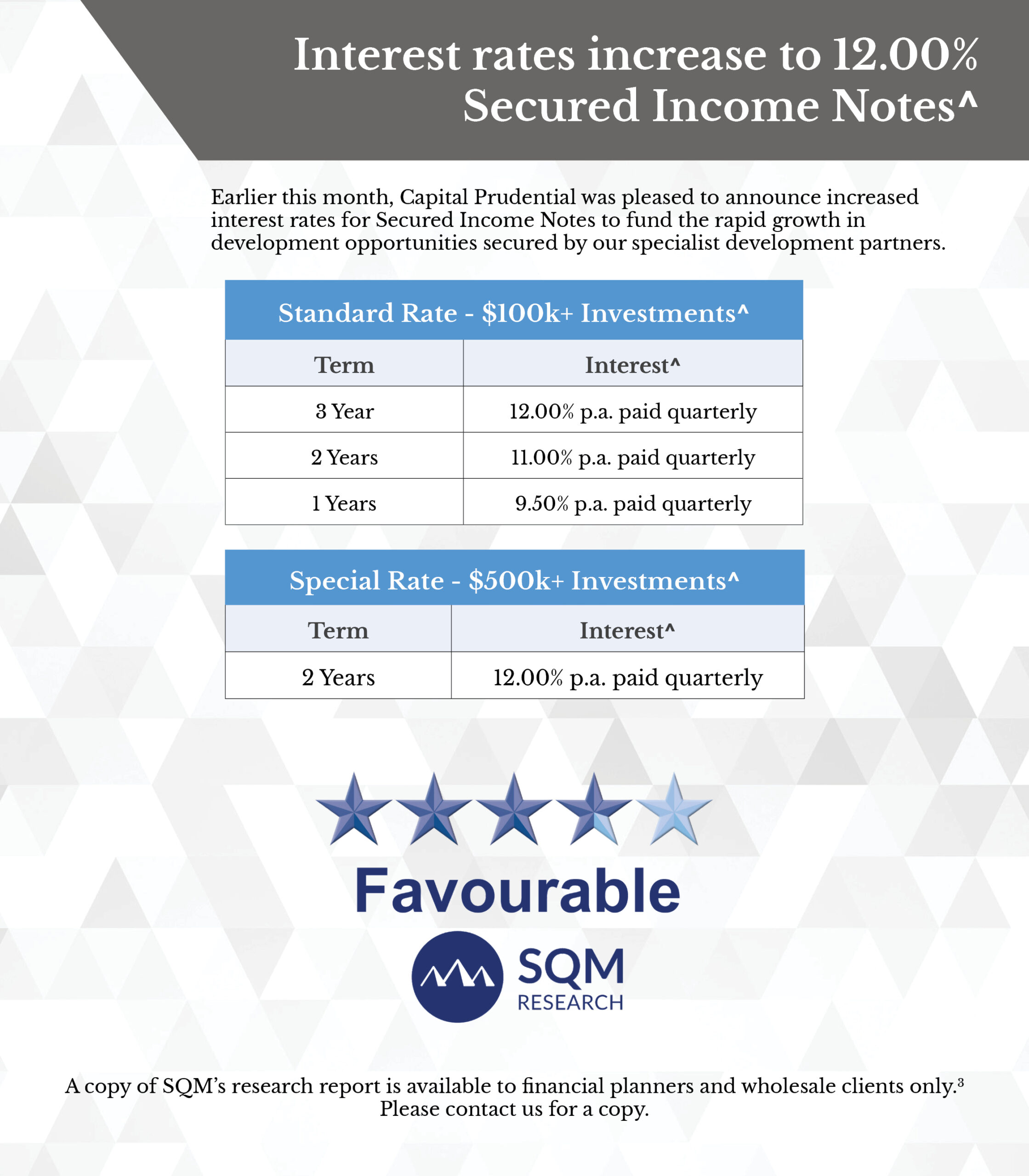

Earlier this month, we announced increased interest rates for the Secured Income Notes to fund this rapid growth in development opportunities, including Jura, Noosa and St Albans, Victoria, featured in this update.

We are also thrilled to announce that our new Capital Prudential Wholesale Real Estate Income Opportunity Fund is now open for investment, providing exposure to Capital Prudential’s property developments through a unitised, open-ended Managed Investment Trust structure. More details may be found in the NEW FUND LAUNCH section below. Please reach out if you would like to understand the new structure or how the options compare in more detail.

We welcome new wholesale investors and intermediaries to contact us if you or your clients could benefit from predictable income returns via our Secured Income Notes or our units in our new Income Opportunity Fund.

Thank you to all our investors, suppliers and partners for your invaluable support.

Sam Moore

Managing Director

M: 0400 285 405

Capital Prudential was excited to announce the launch of the new Income Opportunity Fund on 1 July 2023.

The Income Opportunity Fund is tailored for wholesale clients seeking exposure to property developments across Australia through a unitised, open-ended Managed Investment Trust structure.

Investment Objective

To actively manage a diversified real-estate loan and security portfolio, delivering monthly cash distributions equal to the Target Return.

Target Return: RBA cash rate + 7.00% per annum (net of fees and expenses)1

Currently, 11.10% per annum as at 3 October 2023

Investment Strategy

The Fund offers Investors exposure to diversified real estate investment assets across Australia. Initially, the Fund will invest in Secured Income Notes issued by Capital Prudential Diversified Development Fund Pty Ltd ACN 636 283 219 as trustee of the Capital Prudential Diversified Development Fund. The Secured Income Notes will provide exposure to mid-scale specialty commercial, industrial and boutique residential property developments in Australia and deliver attractive, predictable returns.

Highlights

• Distribution Frequency: Monthly

•Independent Trustee: The Trust Company (RE Services) Limited (ACN 003 278 831; AFSL 235150), part of Perpetual Limited.

•Unit Pricing: Available monthly through Morningstar, FE fundinfo and FundMonitors.com.

•Minimum holding period: 12-month with redemption applications made quarterly.2

TEAM UPDATES

Dave Olsen

– Executive, Risk and Operations

Dave is a senior leader with over 20 years of experience in financial markets. He brings a wealth of experience in banking, risk mitigation, lending, management, and economic advice, with specialist knowledge in complex financial instruments.

Before commencing with Capital Prudential, he was the State Director for SA/NT/TAS Markets at NAB, leading a team of specialists providing market insights and hedging strategies to various businesses.

Dave holds numerous advanced qualifications, including a Graduate Diploma of Applied Finance and Investment, a Bachelor of Economics, a Bachelor of Laws with Honours, and a Graduate Diploma in Legal Practice. He is also accredited by the Australian Financial Management Authority, listed on the Financial Advisors Register (FAR). He has received the Order of Merit in the Institute of Company Directors course. He also completed an intensive business program at Harvard.

Zoe Newman

– Administration Officer

Zoe Newman is an experienced banking professional with a broad range of qualifications ranging from Customer Service to Consumer and Business Lending.

Prior to joining Capital Prudential, she held various Business Banking positions with Bendigo and Adelaide Bank Ltd supporting a diverse team of Relationship Managers with a focus on enhancing customer service, financial analysis, and risk management.

Helan Nobel

– Administration Officer

Helan is a finance professional with extensive

experience in the field of taxation. With a background

in accounting and finance, she honed her skills as a tax

associate at KPMG in India before transitioning into

corporate finance as a Finance and Payroll Administrator

at Zilzie Wines in Mildura. She then worked as an

Assistant Accountant at Chaffey Aged Care in Merbein.

DISCLAIMER: The Secured Income Notes detailed in this update are issued by Capital Prudential Diversified Development Fund Pty Ltd (ACN 636 283 219) (CPDDF) as trustee of the Capital Prudential Diversified Development Fund (the Fund). CPDDF is a Corporate Authorised Representative of Capital Prudential Funds Management Pty Ltd (ACN 636 279 082, AFSL 524725) (CPFM). Capital Prudential Pty Ltd (ACN 634 875 273) (Capital Prudential) is the unitholder and Trust Manager of the Fund and is a Corporate Authorised Representative of CPFM. Capital Prudential is authorised by CPFM to provide advisory and dealing services in connection with the Fund to wholesale clients only.

The information has been only prepared for wholesale clients pursuant to section 761G of the Corporations Act 2001 (Cth) to provide general information only and Capital Prudential did not take into account the investment objectives, financial situation or particular needs of any person when preparing this information. It is not intended to take the place of professional advice and you should, before acting on this information, consider the appropriateness of this information having regard to your personal objectives, financial situation or needs.

Neither Capital Prudential, CPDDF or CPFM or any of their related parties, their employees or directors, provide any warranty of accuracy, completeness or reliability in relation to such information contained within this update or accept any liability to any person who relies on it. Neither Capital Prudential, CPDDF or CPFM guarantees repayment of capital or any particular rate of return from the investment. All opinions and estimates included in this update constitute judgements of Capital Prudential as at the date of the update and are subject to change without notice. Economic and outlook forecasts are not guaranteed to occur and past performance should not be taken as an indicator of future performance.

This update contains an incomplete description of features of the Fund and Secured Income Notes and should be considered in conjunction with the Information Memorandum and other transaction documents (which are available upon request). Investment in the Secured Income Notes is subject to risks including delays in repayment and loss of income and capital invested and is suitable only for potential investors who do not require liquidity for their investments.

1 Capital Prudential Manager Pty Ltd ACN 660 087 847 (CAR 001 298 438) is the issuer of the product materials. For general advice only and does not take account the objectives, financial situation or needs of investors. Read the IM here to see if the product is right for you. All investments contain risk and may lose value. This is a target only; the Fund may not achieve this return.

2 Redemptions are subject to a 12-month lock-up from the date the first Unit is issued. Redemption or Withdrawal notices must be received no less than 30-days prior to a quarter ending March, June, September, or December.

^ The interest rate offered to you at this time may differ from other interest rates offered from time to time. For example, it may differ from the interest rate for any Secured Income Notes previously or subsequently offered and issued. The interest rate for each Secured Income Note will be the rate notified in writing when offered to you as an investor prior to your investment.

3 The rating contained in this document is issued by SQM Research Pty Ltd ABN 93 122 592 036 AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.