We are pleased to provide our quarterly development update for June 2022.

$250 Million Development Milestone Achieved

Since the establishment of Capital Prudential in 2019, we have now surpassed the milestone of $250m in completed, in-progress and up-coming developments. Our development pipeline has continued to diversify and this June update includes two new residential and one commercial project on the Sunshine Coast in Queensland in addition to a major 15,000m2 industrial development in Maddington, Perth.

Capital Prudential continues to take a highly selective and prudent approach to new developments entering the Diversified Development Fund. For example, our Executive Director of Property, Jarrad Haynes has turned down 20 proposals from developers in Melbourne over the past six months, given the higher pricing risk in that location posed by the current economic climate.

While the current economic climate does present upwards pressure on costs and downwards risk on valuations, Capital Prudential is well placed to mitigate these risks. Specifically, we use a wide pre-approved selection of builders to minimise exposure. Our team undertakes a rigorous due diligence process including financial analysis of builders working on our projects and all projects are contracted on a fixed cost basis.

Our exposure to property price fluctuations is mitigated by the large portfolio of developments which are frequently turned over in the fund. As a result, new developments enter the fund at all stages of the property cycle and we are currently enjoying the opportunity to review proposals for new sites at lower price points.

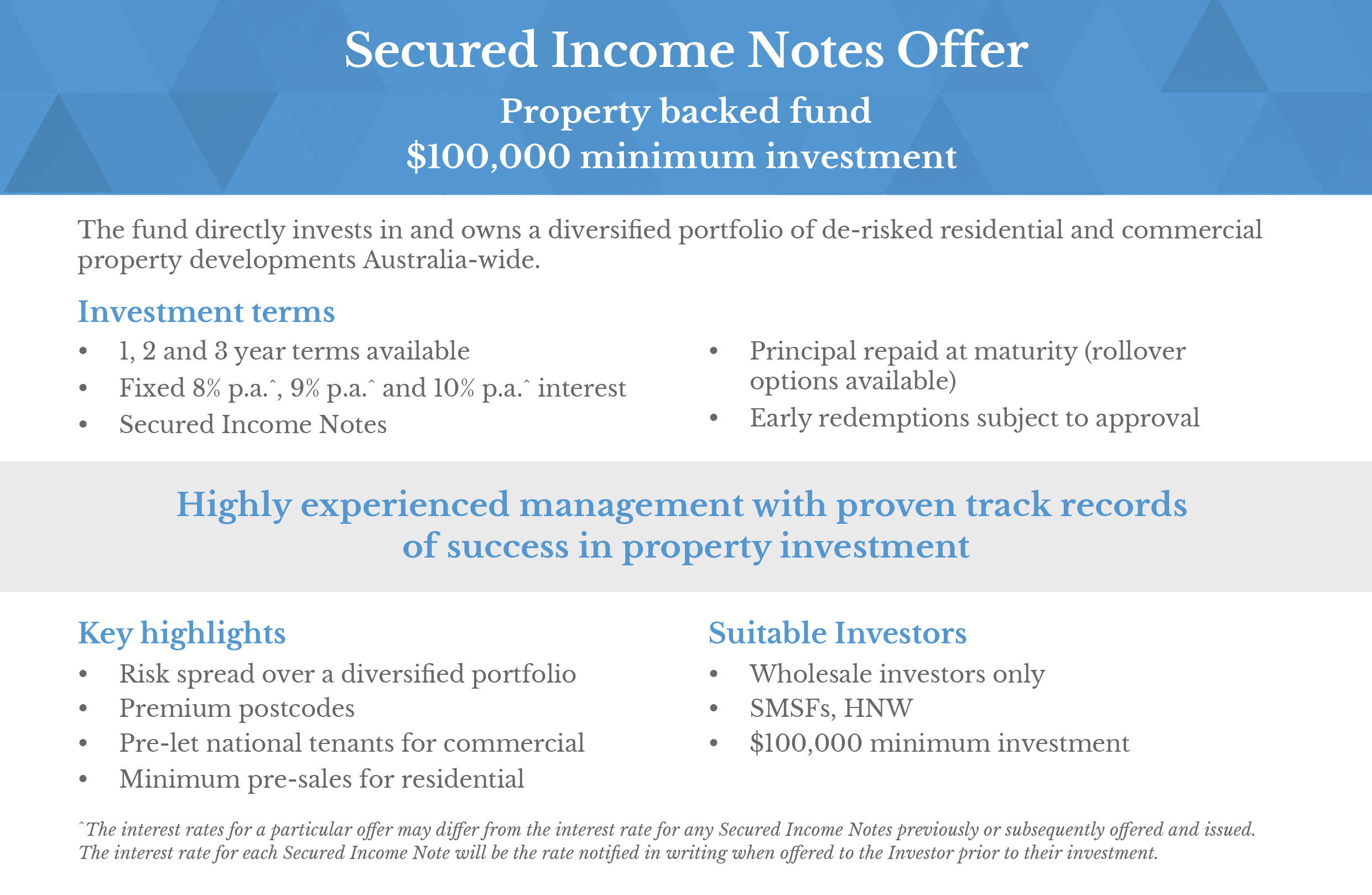

We would like to take this opportunity to thank our current investors for your support. For those interested in quarterly, property backed 10% fixed interest returns, please see further details below.

Sam Moore

Managing Director

Industry Experts Join Our Team

Capital Prudential, the Fund Manager of the Diversified Development Fund has recently appointed the following experts to our team.

Tim Foster – Director, Capital Prudential

Tim is a highly experienced CFO in the finance and property sectors. Tim was previously CFO of the Stockland Property Group and more recently CFO of the property arm of the Qatar Sovereign Wealth Fund leading treasury, risk, governance, planning and performance. Tim also currently serves as CFO of Credit Union SA.

Michael Fazzini – Executive, Sales and Distribution

Michael is extremely well known and respected throughout the funds management industry, having spent 35+ years at AMP Capital. During that time, Michael has had various roles and responsibilities, all of which have centred around distributing AMP Capital investment capabilities via the Financial Planning community. Michael is a former Federal Director of the Australian Financial Security Authority.

Amelia Adams – Manager, Product Delivery and Management

Amelia will lead the delivery and management of Capital Prudential’s investment products. Amelia is a commerce/law graduate with 8+ years banking experience across Westpac, Adelaide Bank and Bendigo Bank. During that time, Amelia held various roles and responsibilities including structured finance, syndicated debt, legal and financial analysis.

Michael explains why he chose to join Capital Prudential

CURRENT DEVELOPMENTS

Address: Gertrude Street, Norwood, South Australia

2 Detached Dwellings

Completion September 2022

Address: Anglesey Avenue, St Georges, South Australia

Detached Dwelling

Completion June 2022

Address: Park Street, Hyde Park, South Australia

Detached Dwelling

Completion December 2022

Address: Wooltana Avenue, Myrtle Bank, South Australia

2 Semi Detached Dwellings

Completion August 2022

Address: Beulah Road, Norwood, South Australia

Commercial Office Building

Completion December 2022

Address: Stepney, South Australia

Otto Townhomes Stage One

21 Semi Detached Dwellings

Completion April 2023

Address: Gawler Terrace, Walkerville, South Australia

3 Detached Townhouses

Completion June 2023

Address: Coglin Street, Brompton, South Australia

20 Semi Detached Dwellings

Completion February 2024

Address: Watson Avenue, Rose Park, South Australia

5 Detached Dwellings

Completion September 2024

Address: Victoria Terrace, Rose Park, South Australia

13 Apartments

Completion September 2024

Address: Stuart Highway, Stuart Park, Northern Territory

Service Station Plus Fast Food

Completion August 2022

Address: Wooltana Avenue, Myrtle Bank, South Australia (adjacent existing development)

2 Detached Dwellings

Completion 2023

Address: Ruskin Street, Byron Bay, New South Whales

2 Semi Detached Dwellings

Completion 2023

UPCOMING DEVELOPMENTS

Address: Stepney, South Australia

Otto Townhomes Stage Two

40 Semi Detached Dwellings

Address: Maryvale Road, Athelstone, South Australia

Mixed Use Commercial & Residential

Address: Wyandra Street, Noosa Heads, Queensland

2 Semi Detached Dwellings

Address: Delorme Street, Noosa Heads, Queensland

2 Semi Detached Dwellings

Address: Maddington Road, Maddington, Western Australia

15,000m2 Industrial

Address: Woodland Drive, Peregian, Queensland

Commercial

RECENTLY COMPLETED DEVELOPMENTS

Address: Anglesey Avenue, St Georges, South Australia

2 Semi Detached Dwellings

Completed 2021

Address: Grandview Grove, Dulwich, South Australia

2 Semi Detached Dwellings

Completed 2021

Address: Inverloch Avenue, Torrens Park, South Australia

2 Semi Detached Dwellings

Completed 2021

DISCLAIMER: The information provided in this email is issued by [Capital Prudential Diversified Development Fund Pty Ltd ACN 636 282 219 (“Capital Prudential”) (a Corporate Authorised Representative of Capital Prudential Funds Management Pty Ltd (“CPFM”) (ABN 83 636 279 082/AFSL 524725) as trustee for the Capital Prudential Diversified Development Fund (the Issuer of the Income Notes) and is only prepared for wholesale clients pursuant to section 761G(7) of the Corporations Act (Cth) 2001. The information has been prepared to provide you with general information only and Capital Prudential did not take into account the investment objectives, financial situation or particular needs of any person when preparing this information. It is not intended to take the place of professional advice and you should, before acting on this information, consider the appropriateness of this information having regard to your personal objectives, financial situation or needs.

Neither Capital Prudential, CPFM or any of their related parties, their employees or directors, provide any warranty of accuracy, completeness or reliability in relation to such information contained within this email or accept any liability to any person who relies on it. Neither Capital Prudential or CPFM guarantees repayment of capital or any particular rate of return from the investment. All opinions and estimates included in this email constitute judgements of Capital Prudential as at the date of the email and are subject to change without notice. Past performance should not be taken as an indicator of future performance.