Our business continues to consolidate and grow. For this calendar year to date we have settled $128M in land purchases across WA, QLD and VIC and started construction on projects worth a total end value of $264.3M.

We have expanded our investment offerings, with the recently announced, successful closure of the Development Equity Fund I. We are excited to have just launched the Development Equity Fund II. The creation of this new investment opportunity set is very exciting as it now allows investors to balance their investment exposure between receiving income or capital, or a combination.

We welcomed to our team two new corporate professionals, Kristie Lenton as our Chief Financial Officer and Tim Brown, Head of Equity Funds.

Thank you to all our investors, suppliers and partners for your invaluable support. We are focussed on ending the calendar year on a high and hope to celebrate with you before the new year.

THE DEVELOPMENT EQUITY FUND SERIES

We are excited to have recently launched Development Equity Fund II – Rothwell. This development asset will comprise 12,000m2 of large format retail space behind three Quick Service Retail pad sites. Investment is now open, please click the link below to reserve your allocation or request further information on the opportunity.

TEAM UPDATES

We are pleased to formally welcome:

Kristie Lenton

Chief Financial Officer

Tim Brown

Head of Equity Fund

FEATURED DEVELOPMENTS

Delorme St Noosa Heads

Duplex with end value of $6.7m – $7m

Construction completed in October 2024

A SELECTION OF OUR CURRENT DEVELOPMENTS

Belvedere Business Park, Queensland

21 Commercial Tenancies

Completion 2025

Alderley, Queensland

Breathe Residencies: 51 Luxury Apartments

Completion 2025

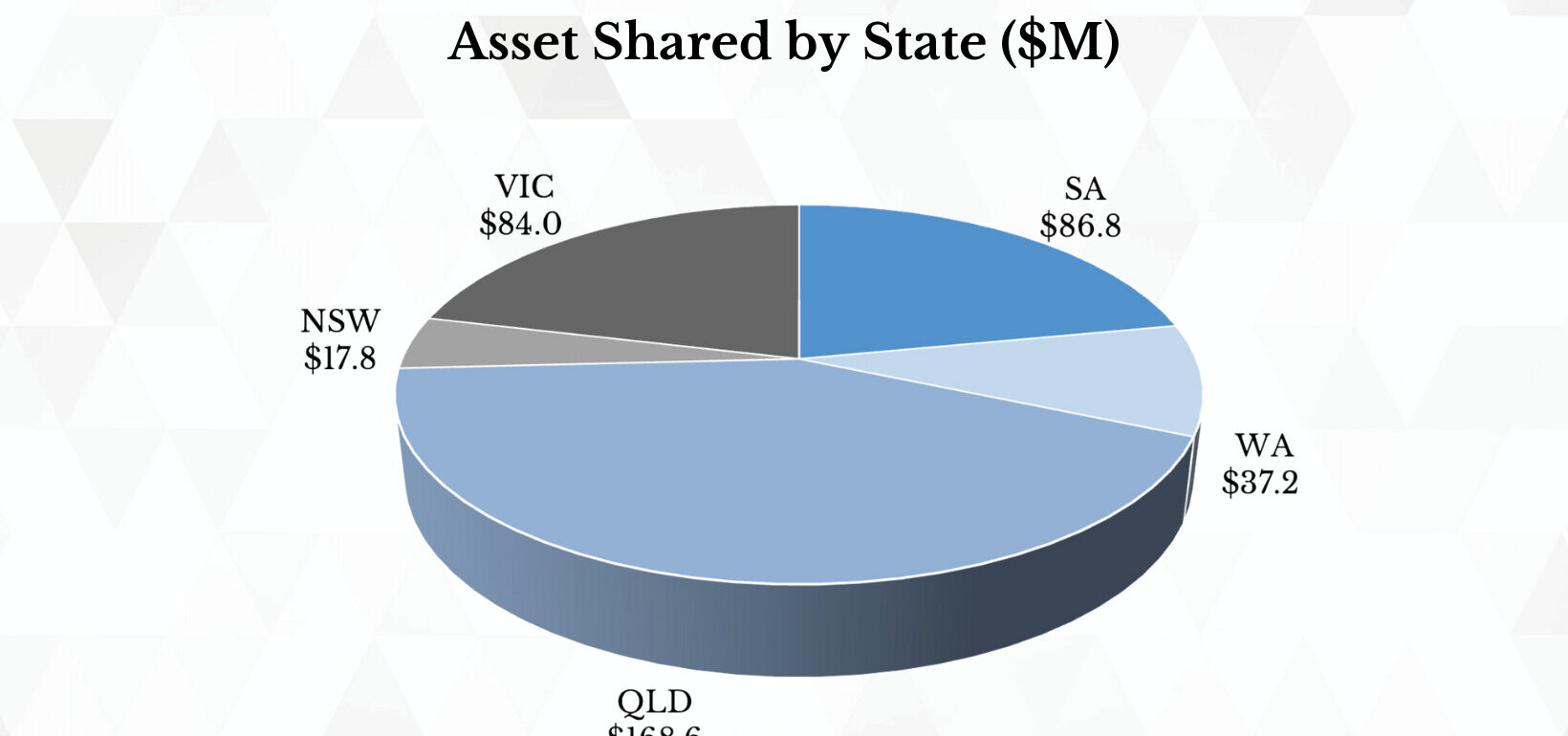

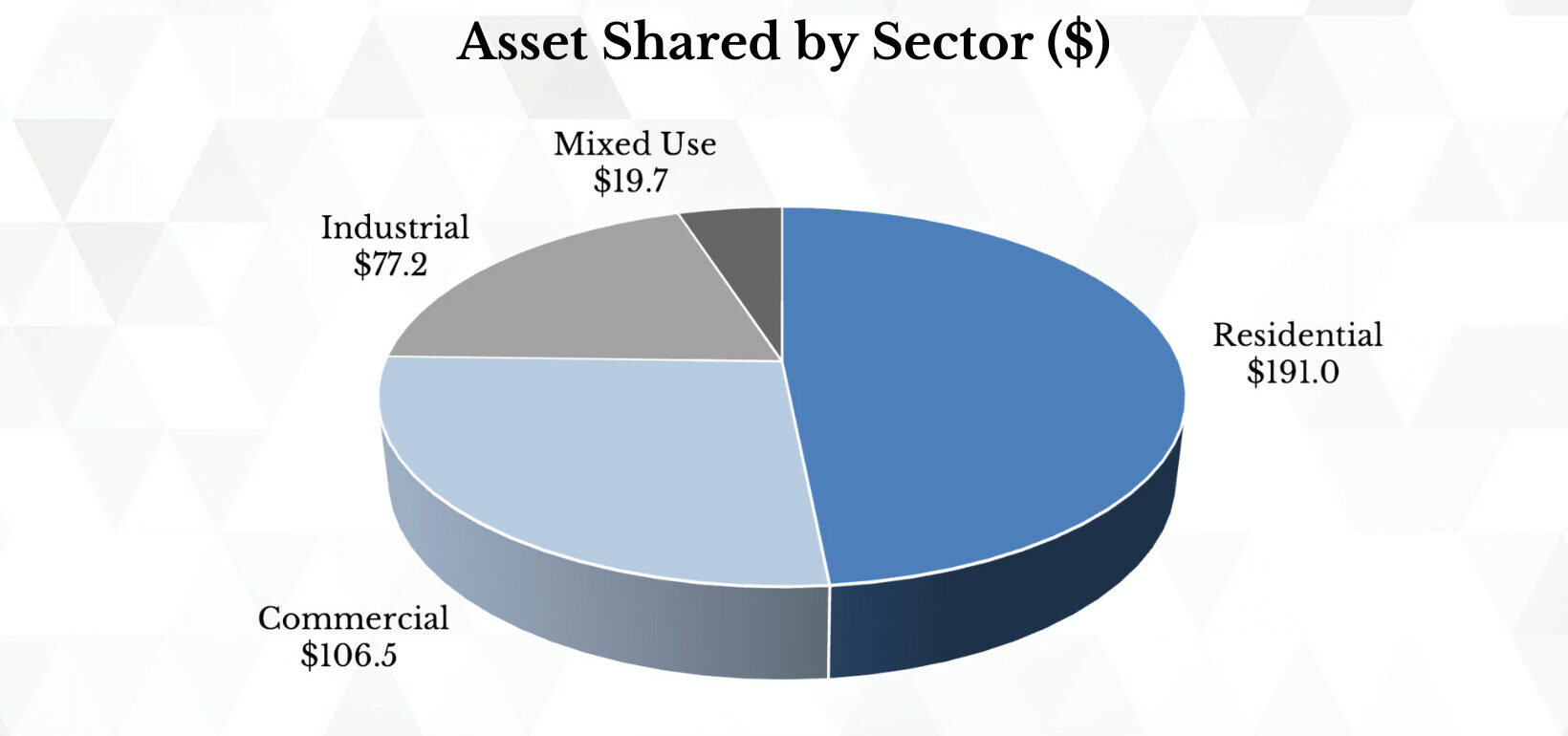

The graphs below illustrate the diverse portfolio of the property development assets owned by the Capital Prudential Diversified Development Fund as at 31 October 2024.

DISCLAIMER: This information has been prepared and issued by Capital Prudential Funds Management Pty Ltd (ABN 83 636 279 082/AFSL 524725) (CPFM) and is intended for use only by wholesale clients pursuant to section 761G(7) or 761GA of the Corporations Act 2001 (Cth). This information is not intended for any person who is a retail client within the meaning of section 761G or 761GA of the Corporations Act 2001 (Cth).

Capital Prudential Diversified Development Fund Pty Ltd ACN 636 282 219 (CPDDF) is the trustee of, and issuer of securities in, the Capital Prudential Diversified Development Fund. The Trust Company (RE Services) Limited ACN 003 278 831, AFSL 235 150 (TTCRESL) is the trustee and issuer of units in the Capital Prudential Real Estate Master Trust and Development Equity Fund I and II. Perpetual Trust Services Limited (ACN 000 142049; AFSL 236 648) (PTSL) is the responsible entity and the issuer of units in the Capital Prudential Retail Real Estate Master Trust. Capital Prudential Manager Pty Ltd ACN 660 087 847 (authorised representative of CPFM) (Investment Manager) is the investment manager of the Capital Prudential Real Estate Master Trust and Capital Prudential Retail Real Estate Master TrustDevelopment Equity Fund I and II.

This information is general only and is not personal advice. It has been prepared without taking into account your objectives, financial situation or needs. If you require financial advice that takes into account your personal objectives, financial situation or needs, consult your financial adviser. You should consider the relevant Information Memorandum, Product Disclosure Statement and Target Market Determination available by visiting our website https://capitalprudential.com.au/, prior to making any investment decisions.

Neither the Investment Manager, CPDDF, CPFM, TTCRESL, PTSL, their employees or directors, or any of their related parties (including Perpetual Limited ABN 86 000 431 827 and its subsidiaries) provide any warranty of accuracy, completeness or reliability in relation to the information contained herein or accept any liability to any person who relies on it.

Any opinions, forecasts, estimates or projections reflect judgments of the Investment Manager as at the date of this publication and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct. Actual returns could differ significantly from any forecasts, estimates or projections provided. Past performance is not a reliable indicator of future performance.

This information is current only as at the date indicated and may be superseded by subsequent market events or for other reasons. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. All investments contain risk and may lose value.

1 This is a target only, the Fund may not achieve this return.