The first quarter of 2025 has seen strong momentum across our platform as we continue to execute our growth strategy in a shifting market landscape.

During the quarter, we progressed the deployment of capital from the Capital Prudential Development Equity Fund II into the Rothwell property in South-East Queensland. This project is well positioned to benefit from renewed buyer confidence and stabilising construction costs. At the same time, we’ve advanced planning on a new income-focused vehicle aimed at delivering consistent yields through exposure to premium commercial assets.

Macroeconomic conditions continue to evolve. The Reserve Bank’s cautious approach to monetary easing is beginning to restore liquidity to the property market, with continuing signs of price recovery in key metro areas. This, combined with strong population growth and undersupply of housing, continues to underpin our core investment thesis.

Internally, we’ve invested further in our risk, development, and investor relations teams to ensure we remain agile and transparent as we scale. Our governance framework also continues to mature, with preparations underway for the next stage of Board evolution to support our expanding fund suite.

Looking ahead, we are bringing two new investment opportunities to market in Q2, further broadening our offering across both equity and debt strategies, see further details below.

We remain focused on delivering value to our investors while navigating changing conditions with discipline and clarity.

Thank you for your ongoing support.

Jarrad Haynes

Managing Director

M: 0431 220 988

TWO NEW EXCITING OPPORTUNITIES

COMING SOON

Capital Prudential Industrial Fund I

The new Capital Prudential Industrial Fund I will provide investors access to core income returns from a high-quality industrial logistics asset located in Maddington, WA. The site will be home to major tenants including Westgold Ltd and EWE Logistics. Spanning 15,370 sqm of net lettable area, this facility is poised to offer reliable income streams to investors.

7% Five Year Target Cash Yield**

** This is a target only and is not guaranteed. Actual returns may differ.

Stay tuned for more details about this promising investment opportunity.

Capital Prudential Development Equity Fund III

We’re excited to announce the upcoming launch of our third development equity fund, providing investors with equity exposure to mid-scale build-to-sell real estate projects in Australia. This fund will target up to five industrial strata warehouse development projects in major city locations over a three to five year investment horizon.

Register your interest here to be the first to receive further information on the fund.

Please contact us if you wish to discuss your investment options

THE DEVELOPMENT EQUITY FUND SERIES

Development Equity Fund I

Jandakot Business Park, WA

We are pleased to report significant progress on our construction project, with Alita Construction completing early in-ground works and laying the slab. In the past two weeks, the tilt panels have started to be raised, as shown in the time-lapse video below. The local Mayor and Member of Parliament attended a ceremony to mark this milestone.

On the sales front, we’ve secured 11 pre-sale contracts, with five additional units under offer. We’re now over 30% sold and as buildings take shape, we anticipate increased sales momentum.

Development Equity Fund II

Rothwell Homemaker Centre, QLD

In January, we settled on the land at 463 Anzac Avenue, Rothwell, just north of Brisbane, and are pleased to announce that Fresh & Save Supermarket has signed a lease for 4,300 sqm, marking a significant milestone for the project. Our leasing strategy has been adjusted to accommodate a larger development plan, and we’re in talks with several tenants for the remaining large-format spaces.

COMING SOON - PRIVATE CREDIT INCOME FUNDS

More information will be announced in the next Quarterly Update.

A SELECTION OF OUR CURRENT DEVELOPMENTS

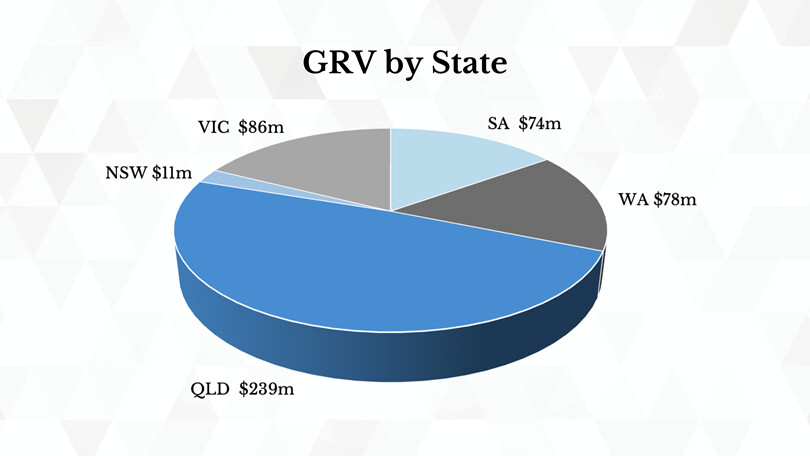

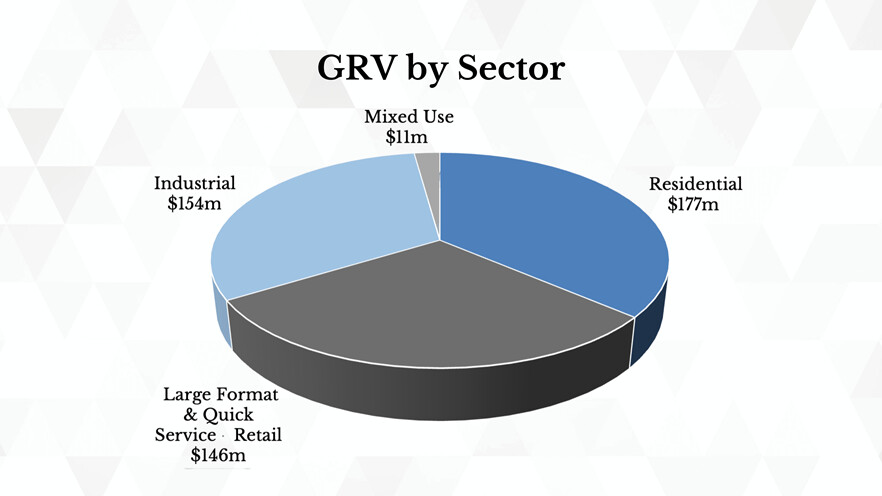

The following graphs illustrate the diverse portfolio of real estate development assets in terms of Gross Realisable Value (GRV) to which the Capital Prudential Funds provide exposure.

DISCLAIMER: This information has been prepared and issued by Capital Prudential Funds Management Pty Ltd (ABN 83 636 279 082; AFSL 524725) (CPFM) and is intended for use only by Wholesale Clients pursuant to section 761G(7) or 761GA of the Corporations Act 2001 (Cth) (Corporations Act). This information is not intended for any person who is a retail client within the meaning of section 761G or 761GA of the Corporations Act.

Capital Prudential Diversified Development Fund Pty Ltd (ACN 636 282 219) (CPDDF) is the trustee of, and issuer of securities in, the Capital Prudential Diversified Development Fund. The Trust Company (RE Services) Limited (ACN 003 278 831; AFSL 235 150) (TTCRESL) is the trustee and issuer of units in the Capital Prudential Real Estate Master Trust and the Capital Prudential Development Equity Fund I and II. Perpetual Trust Services Limited (ACN 000 142049; AFSL 236 648) (PTSL) is the responsible entity and the issuer of units in the Capital Prudential Retail Real Estate Master Trust.

Capital Prudential Pty Ltd (ACN 634 875 273; CAR 1298940) (Fund Manager) is the fund manager of the Capital Prudential Diversified Development Fund and Capital Prudential Manager Pty Ltd (ACN 660 087 847; CAR 001 298 438) (Investment Manager) is the investment manager of the Capital Prudential Real Estate Master Trust, Capital Prudential Retail Real Estate Master Trust, and the Capital Prudential Development Equity Fund I and II.

This information is general only and is not personal advice. It has been prepared without taking into account your objectives, financial situation or needs. If you require financial advice that takes into account your personal objectives, financial situation or needs, consult your financial adviser. You should consider the relevant Information Memorandum, Product Disclosure Statement and Target Market Determination available by visiting our website https://capitalprudential.com.au/, prior to making any investment decisions.

Neither the Fund Manager, Investment Manager, CPDDF, CPFM, TTCRESL, PTSL, their employees or directors, or any of their related parties (including Perpetual Limited ABN 86 000 431 827 and its subsidiaries) provide any warranty of accuracy, completeness or reliability in relation to the information contained herein or accept any liability to any person who relies on it.

Any opinions, forecasts, estimates or projections reflect judgments of the Investment Manager as at the date of this publication and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct. Actual returns could differ significantly from any forecasts, estimates or projections provided. Past performance is not a reliable indicator of future performance.

This information is current only as at the date indicated and may be superseded by subsequent market events or for other reasons. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. All investments contain risk and may lose value.