The last quarter was pivotal in re-positioning the business for our next phase of expansion, marked by the successful first close of Development Equity Fund II, the strategic growth of our team and further enhancements to our governance framework, including the appointment of independent directors to the Capital Prudential Diversified Development Fund Pty Ltd Board.

It will be a fascinating year ahead amidst the transition of power in the US, conflicts in Ukraine and the Middle East and a local Federal Election.

In terms of domestic monetary policy, the prospect of a lower interest rate environment is expected to spark recovery in east coast residential property prices and drive competition for premium commercial assets, offering long-term rental security.

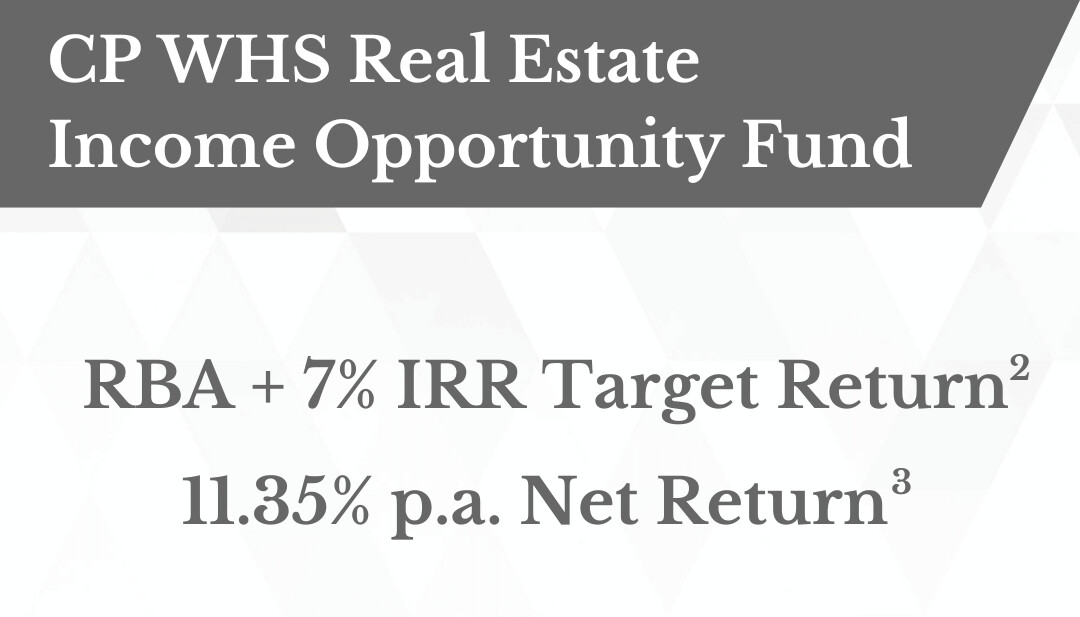

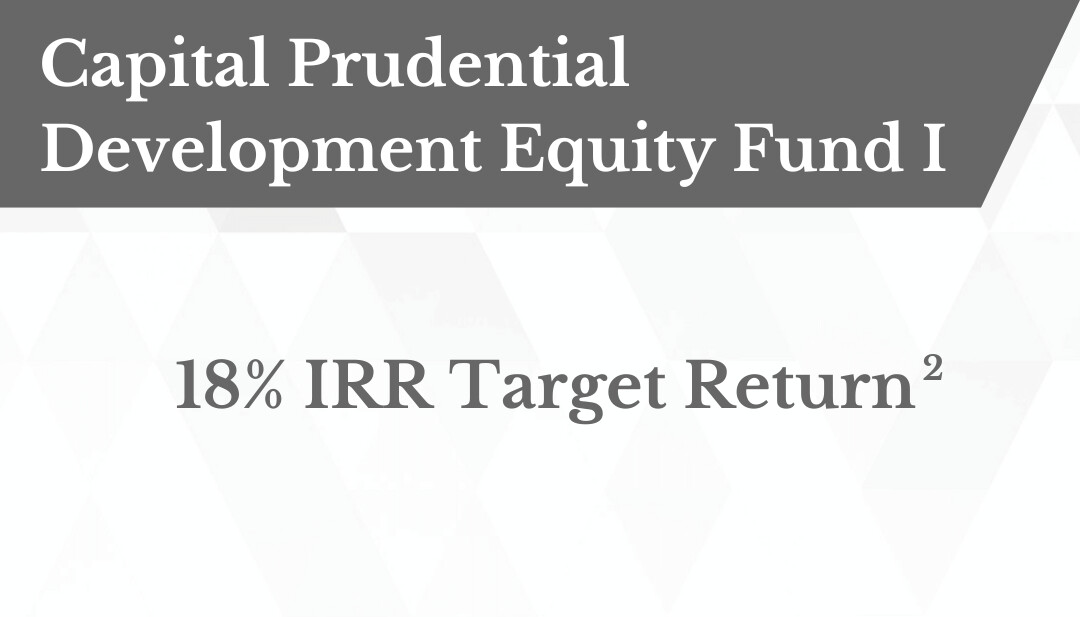

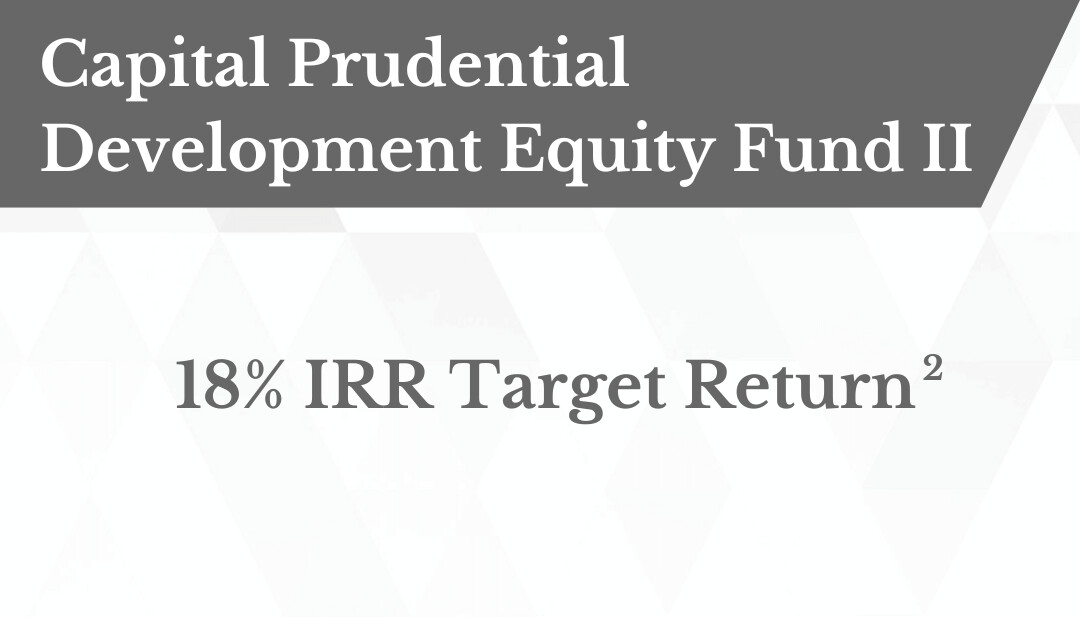

Leveraging our expertise, we now offer five investment opportunities providing exposure to real estate development – allowing for a balance between income and growth assets – with additional opportunities to be announced in 2025.

We appreciate your continued support.

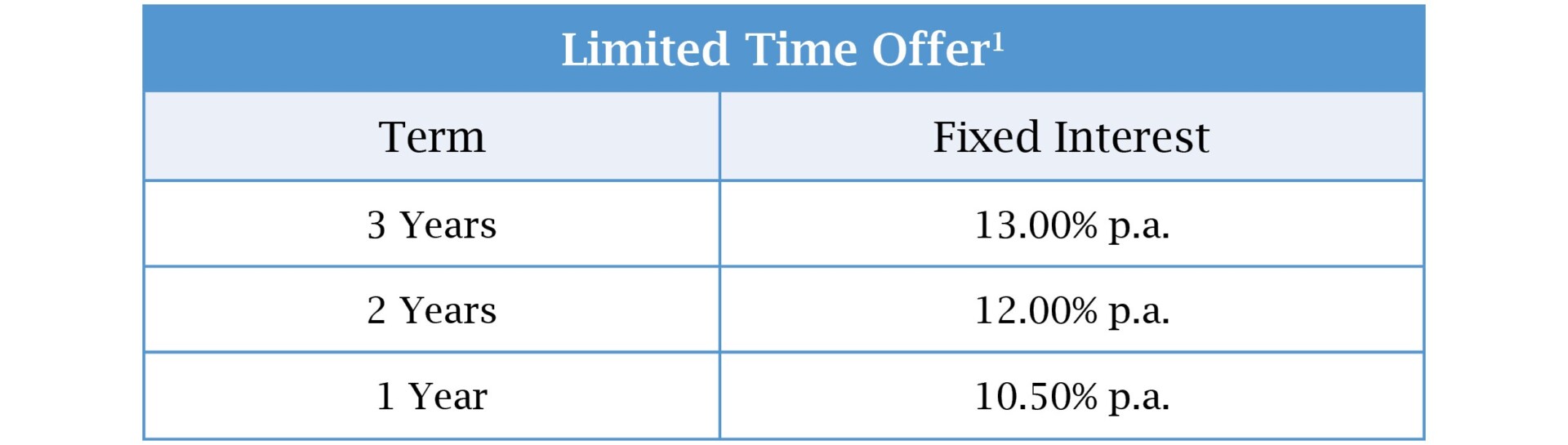

In celebration of the New Year, we are offering a 1.00% p.a. uplift across our standard rates for new Secured Income Notes issued on or before 28 February 2025.

Register below to take advantage of this limited time opportunity to secure attractive, fixed interest rates today.

This offer is only available to Wholesale Clients as defined by the Corporations Act 2001 (Cth).

1 The interest rates for a particular offer may differ from the interest rate for any Secured Income Notes previously or subsequently offered and issued. The interest rate for each Secured Income Note will be the rate notified in writing when offered to the Investor prior to their investment.

THE DEVELOPMENT EQUITY FUND SERIES

Capital Prudential Development Equity Fund I: Jandakot Business Park, WA

The proposed land parcel at Prinsep Road, Jandakot settled in October. Alita Constructions immediately commenced construction works and Phase 1 (Civil and Sewer Connection Works) is now complete. This enabled subdivision of the site and the pre-sale of an allotment to a major Australian self storage operator in December.

Capital Prudential Development Equity Fund II: Rothwell Homemaker Centre, QLD

Following a successful first capital raising, the Rothwell land was settled in early January. Pre-leasing is continuing and subdivision work has commenced. The fund remains open for investment before construction commences in earnest. If you would like to participate in this exciting mid scale retail development targeting an IRR of 18% p.a. please register your interest below.

PERFORMANCE ACROSS THE CAPITAL STACK

Please contact us if you wish to discuss your investment options.

2 This is a target only and may not be achieved.

3 Total Returns shown have been calculated using exit prices after taking into account all of fund ongoing fees. No allowance has been made for taxation. Past performance is not indicative of future performance.

TEAM UPDATES

We are pleased to formally welcome:

Carolyn Mitchell

CPDDF

Independent Director

Stephen Bull

CPDDF

Independent Chairman

Julia Foster-Massie

Project Director (Qld)

Christian Sougleris

Project Manager

Shirley Shu

Company Secretary and Head of Governance

Anna Lolosidis

Senior Manager, Operations

A SELECTION OF OUR CURRENT DEVELOPMENTS

The following graphs illustrate the diverse portfolio of real estate development assets in terms of Gross Realisable Value (GRV) to which the Capital Prudential Diversified Development Fund and Capital Prudential Wholesale Real Estate Income Opportunity Fund provide exposure.

DISCLAIMER: This information has been prepared and issued by Capital Prudential Funds Management Pty Ltd (ABN 83 636 279 082; AFSL 524725) (CPFM) and is intended for use only by Wholesale Clients pursuant to section 761G(7) or 761GA of the Corporations Act 2001 (Cth) (Corporations Act). This information is not intended for any person who is a retail client within the meaning of section 761G or 761GA of the Corporations Act.

Capital Prudential Diversified Development Fund Pty Ltd (ACN 636 282 219) (CPDDF) is the trustee of, and issuer of securities in, the Capital Prudential Diversified Development Fund. The Trust Company (RE Services) Limited (ACN 003 278 831; AFSL 235 150) (TTCRESL) is the trustee and issuer of units in the Capital Prudential Real Estate Master Trust and the Capital Prudential Development Equity Fund I and II. Perpetual Trust Services Limited (ACN 000 142049; AFSL 236 648) (PTSL) is the responsible entity and the issuer of units in the Capital Prudential Retail Real Estate Master Trust.

Capital Prudential Pty Ltd (ACN 634 875 273; CAR 1298940) (Fund Manager) is the fund manager of the Capital Prudential Diversified Development Fund and Capital Prudential Manager Pty Ltd (ACN 660 087 847; CAR 001 298 438) (Investment Manager) is the investment manager of the Capital Prudential Real Estate Master Trust, Capital Prudential Retail Real Estate Master Trust, and the Capital Prudential Development Equity Fund I and II.

This information is general only and is not personal advice. It has been prepared without taking into account your objectives, financial situation or needs. If you require financial advice that takes into account your personal objectives, financial situation or needs, consult your financial adviser. You should consider the relevant Information Memorandum, Product Disclosure Statement and Target Market Determination available by visiting our website https://capitalprudential.com.au/, prior to making any investment decisions.

Neither the Fund Manager, Investment Manager, CPDDF, CPFM, TTCRESL, PTSL, their employees or directors, or any of their related parties (including Perpetual Limited ABN 86 000 431 827 and its subsidiaries) provide any warranty of accuracy, completeness or reliability in relation to the information contained herein or accept any liability to any person who relies on it.

Any opinions, forecasts, estimates or projections reflect judgments of the Investment Manager as at the date of this publication and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct. Actual returns could differ significantly from any forecasts, estimates or projections provided. Past performance is not a reliable indicator of future performance.

This information is current only as at the date indicated and may be superseded by subsequent market events or for other reasons. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. All investments contain risk and may lose value.