As we reflect on our Financial Year 23/24, we are proud to share several key highlights that showcase our progress and achievements.

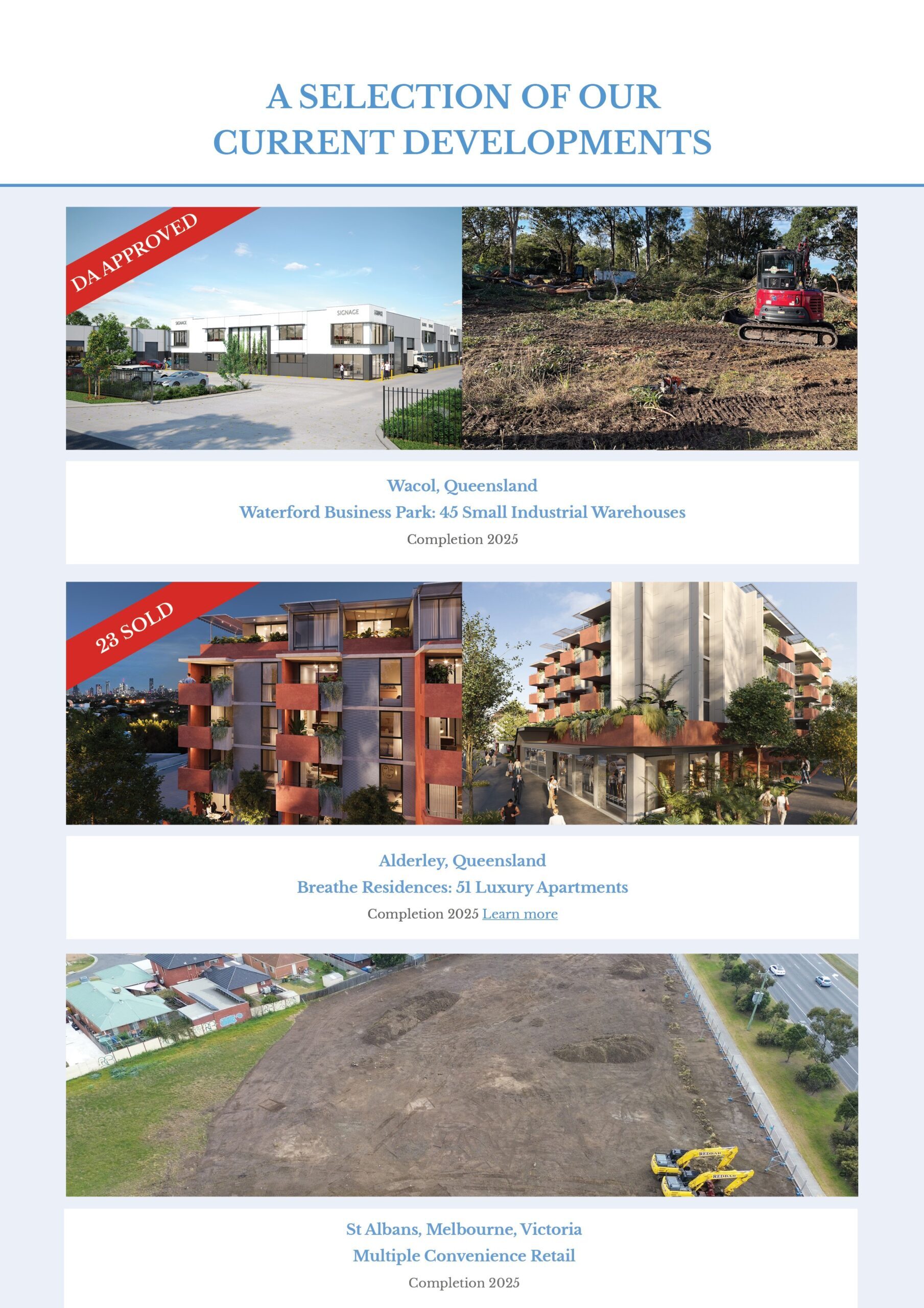

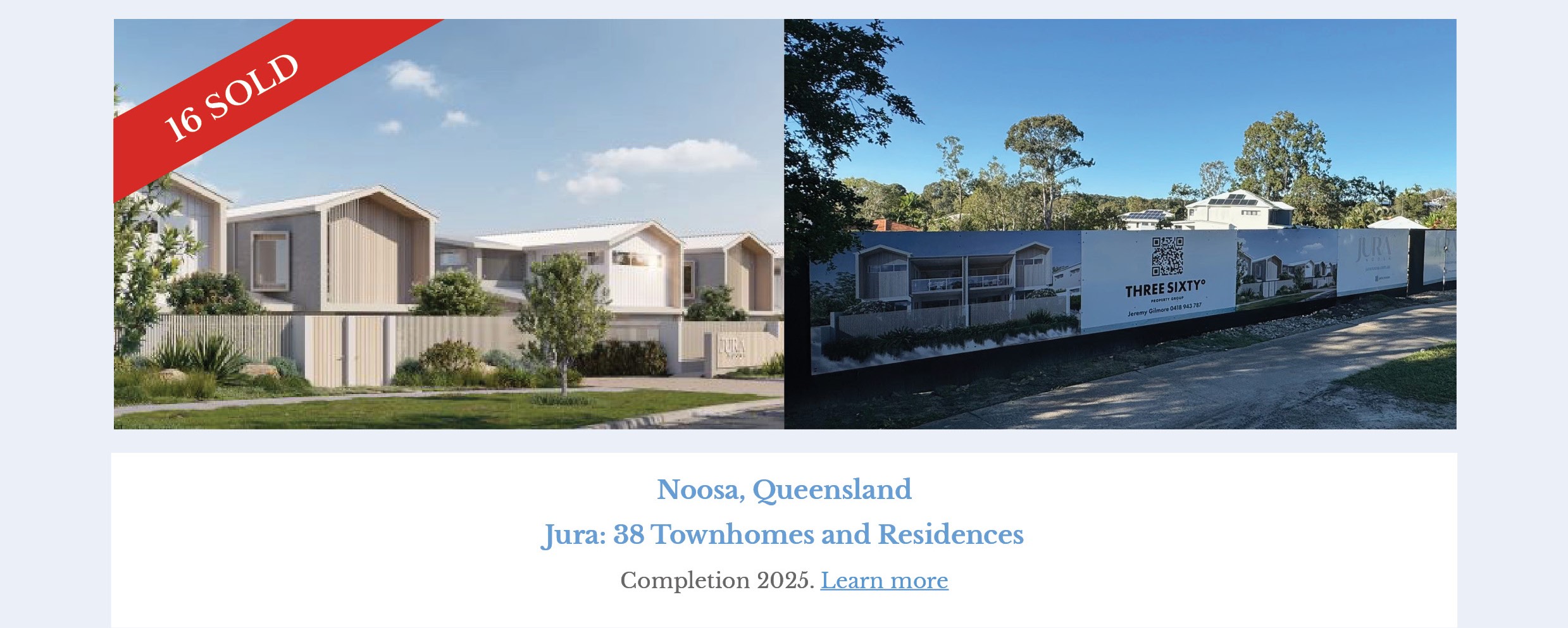

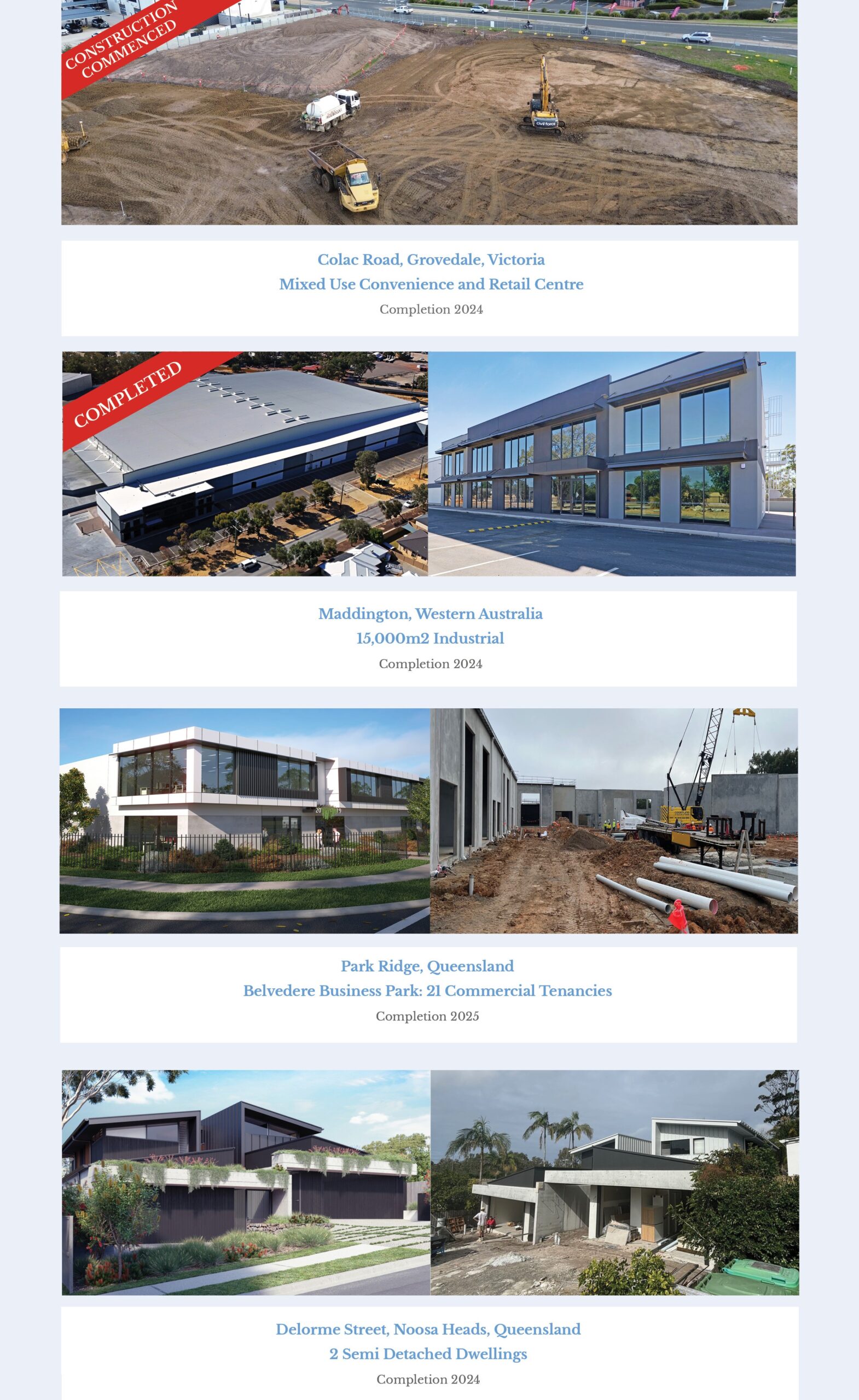

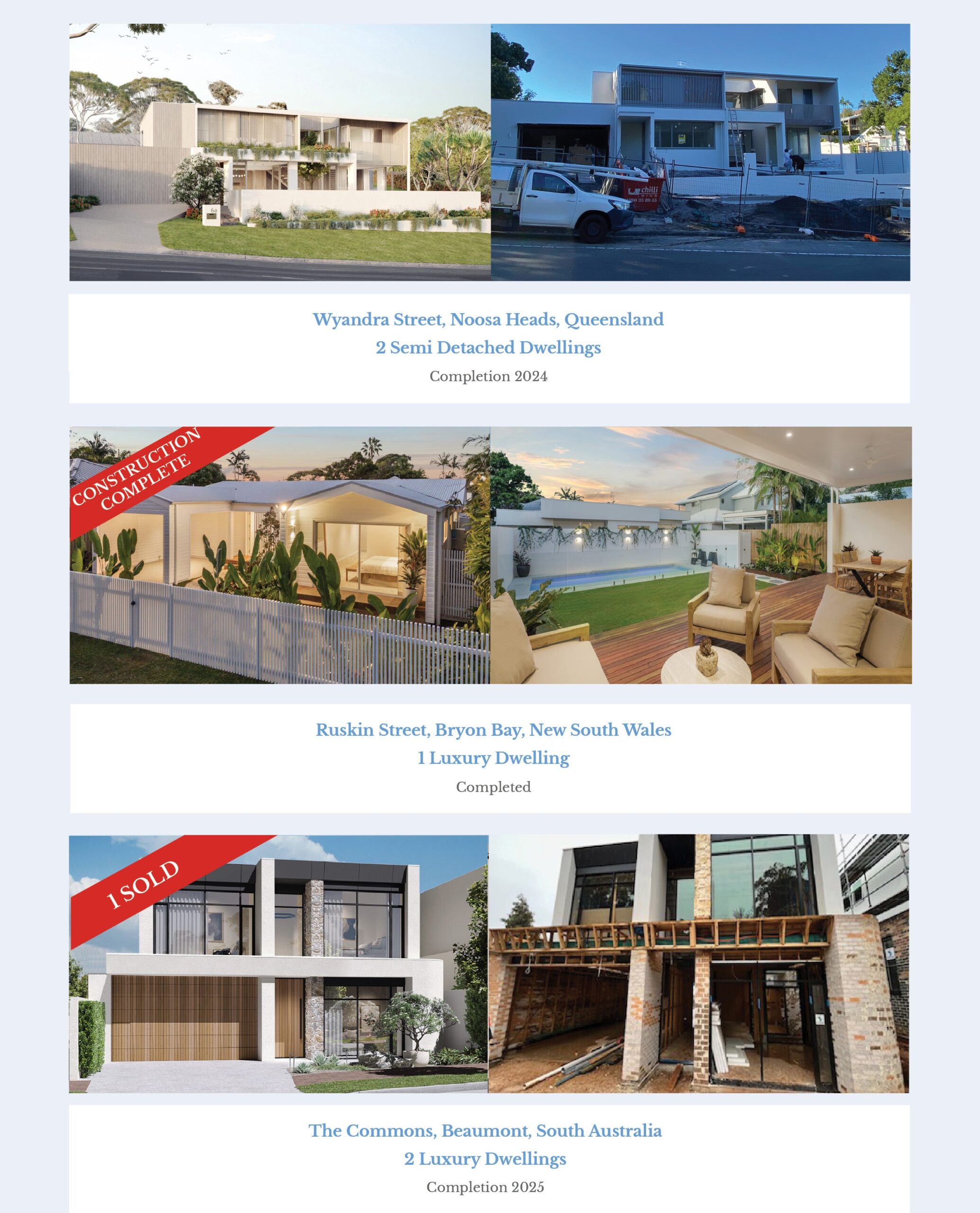

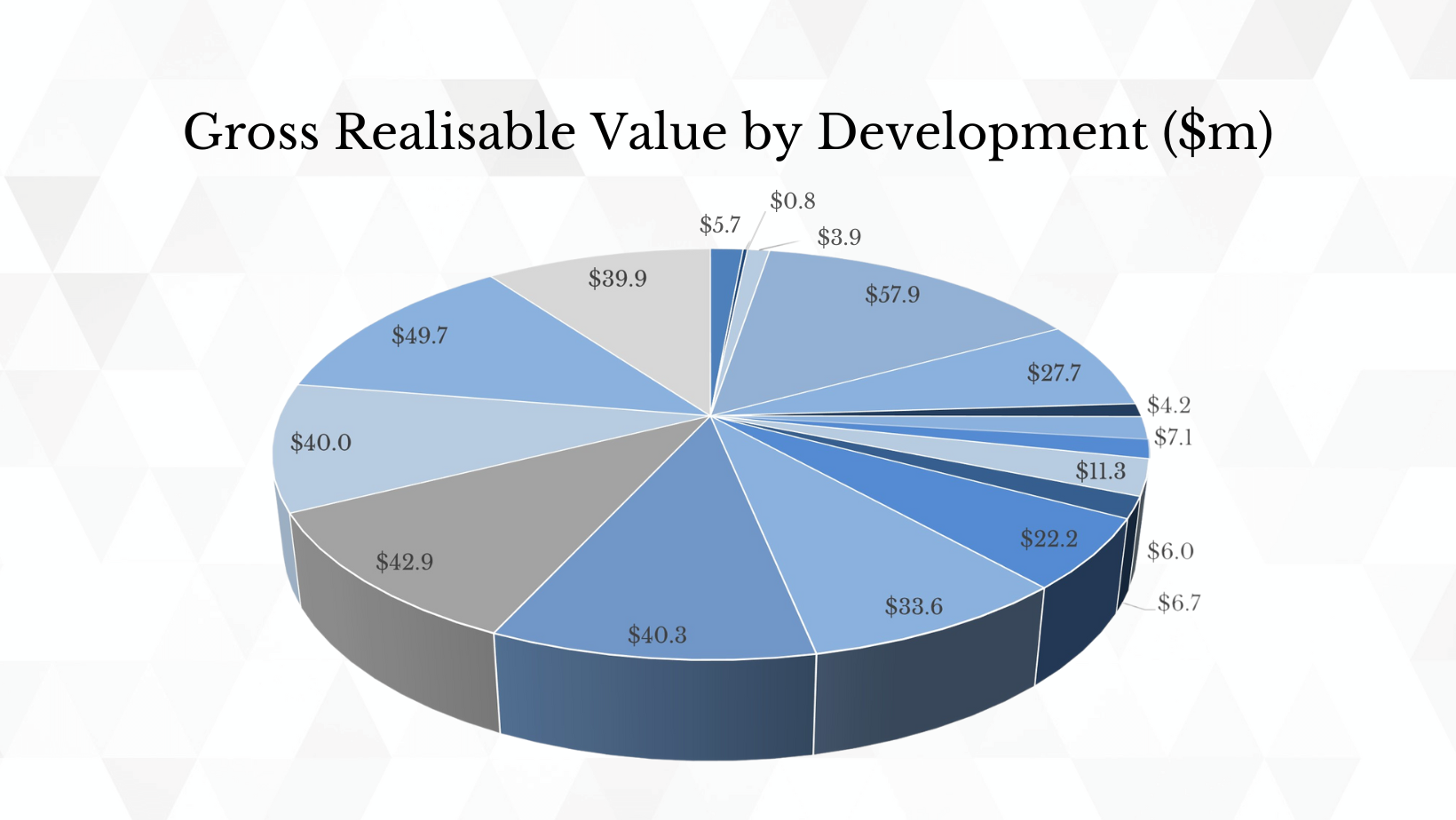

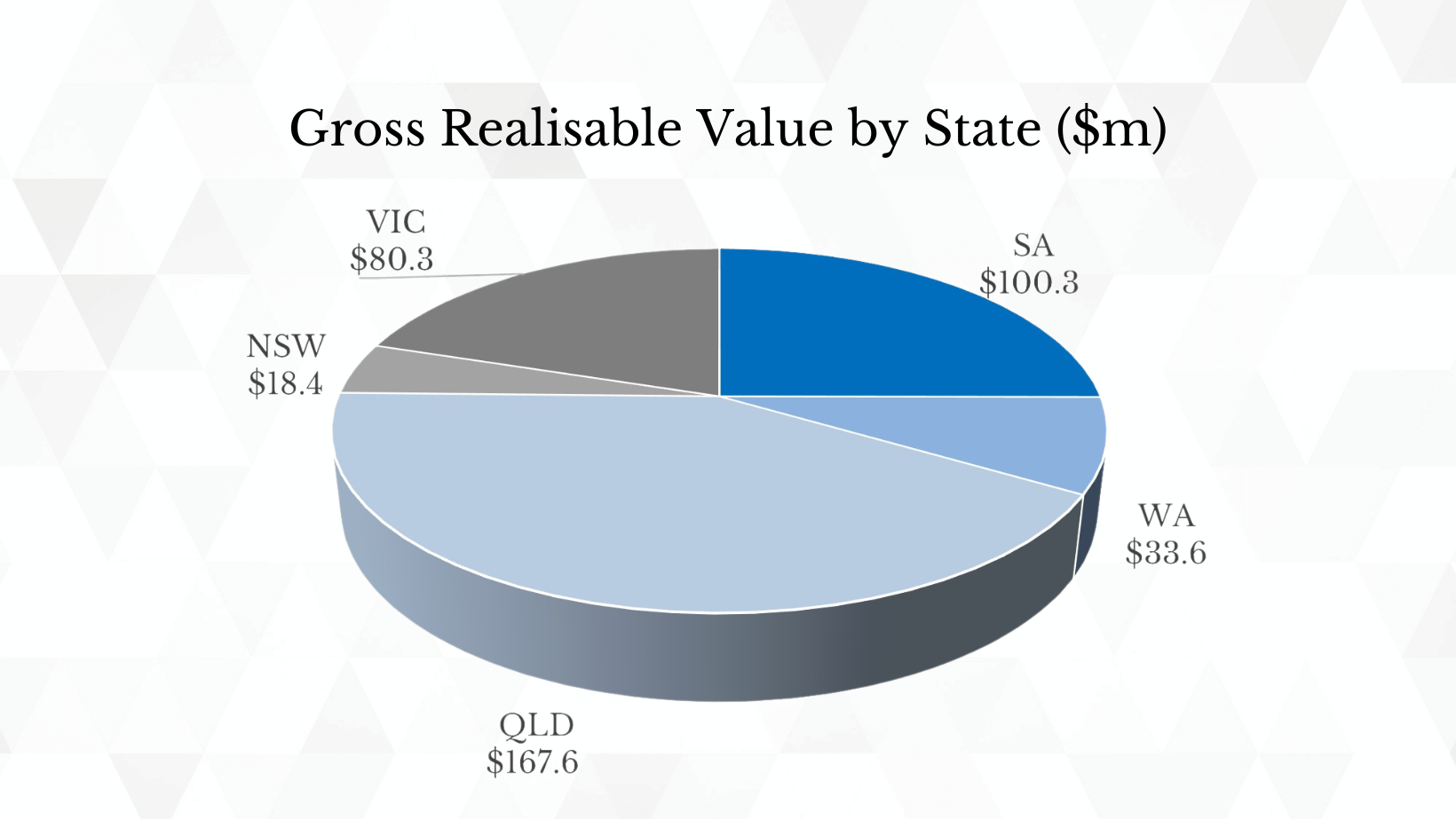

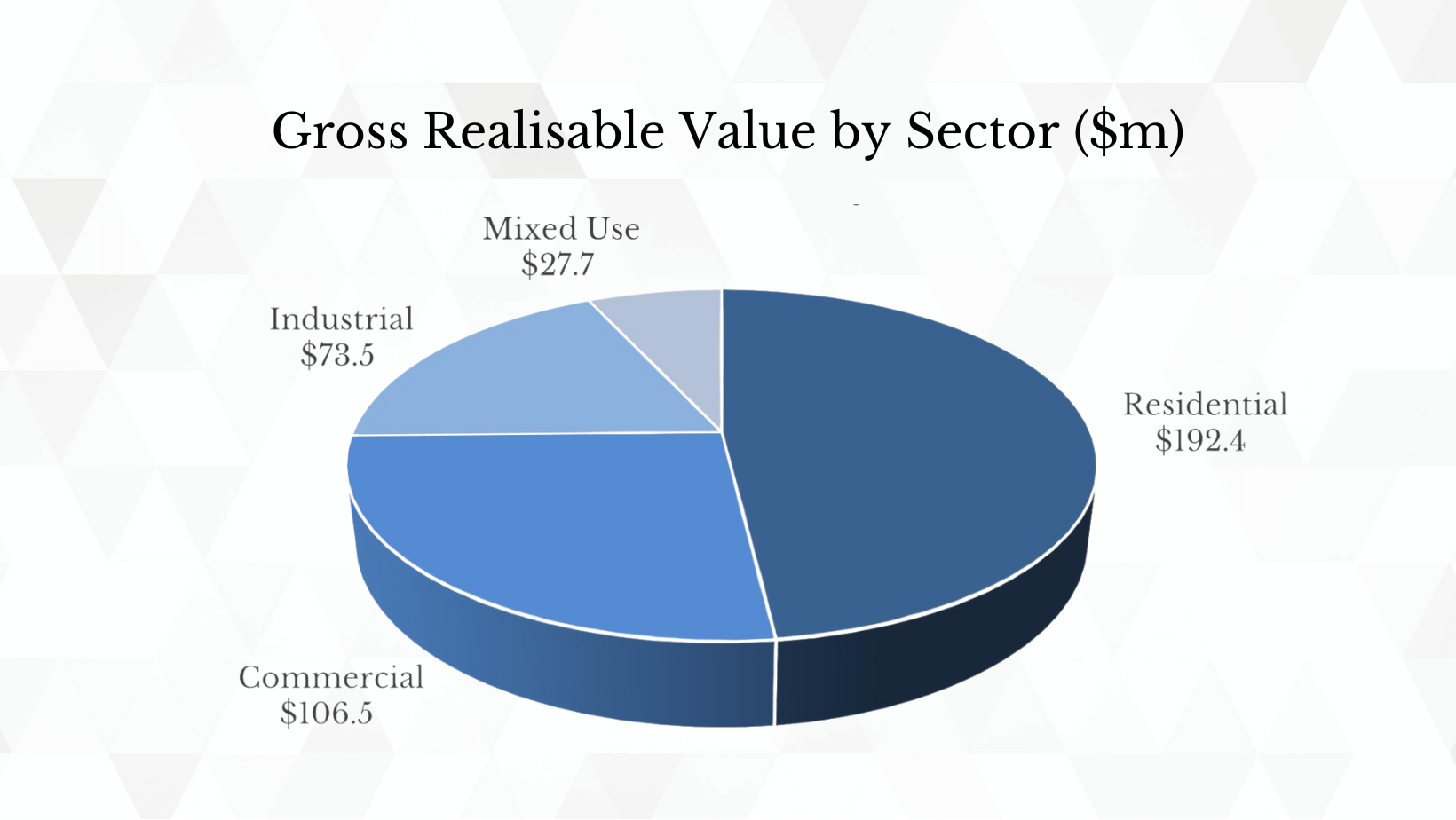

We completed 14 bespoke residential properties valued at $27 million this year, bringing our total completed andcurrent developments across Australia to a significant milestone of $511 million. Our geographic diversification strategy was a success with new property developments commencing in Queensland and Victoria, effectively reducing our exposure in South Australia from 56% to 25%. We also made significant progress in diversifying our property types by introducing our first industrial development asset, bringing the residential property proportion of our portfolio down to 48%.

Our team was strengthened as we welcomed six highly experienced development managers and corporate professionals, namely Jack Bennett, Clancy Sprouster, Matt Hynes, Debby Nathanael, Dave Brewin, and Jackson Greatrex.

The Capital Prudential Diversified Development Fund retained its Favourable 3.75 Star Rating from SQM Research. Strengths of the Fund highlighted in the independent report included its asset diversification, experienced investment team, sound risk management processes and access to relatively high, fixed income returns through the Secured Income Notes program. Current carded rates are 12% for 3 years, 11% for 2 years or 9.5% for 1 Year.1

The Capital Prudential Wholesale Real Estate Income Opportunity Fund and the Capital Prudential Real Estate Income Opportunity Fund launched in July and August 2023, respectively. Both innovative new investment opportunities received Favourable 3.75 inaugural Star Ratings from SQM Research and are now available on various investment platforms, including DASH and Hub24.2

We were also honoured to have been awarded the GS007 Type 1 Assurance for Investment Management Services by Deloitte, a testament to our commitment to our operational excellence and integrity.

Thank you to all our investors, suppliers, and partners for your invaluable support. We look forward to continuing our successful journey together.

TEAM UPDATES

We are pleased to formally welcome Debby Nathanael as Assistant Accountant and Matt Hynes as Senior Development Manager.

Debby Nathanael

– Assistant Accountant

Debby is a passionate accounting professional who is currently working to obtain her Chartered Accountant designation from CAANZ.

Before joining Capital Prudential, she gained experience in external audit at one of the Big4 accounting firms in Adelaide. Prior to that, she worked at a mid-tier accounting firm, where she specialised in taxation and business services.

Matt Hynes

– Senior Development Manager

Matt has extensive property experience in a career spanning 20 years managing high performance teams in residential, commercial, student accommodation and build to rent sectors.

Matt has successfully delivered projects in Queensland, NSW, and Victoria ensuring optimal outcomes in the ever-challenging variables of property development.

He has worked for private boutique developers and ASX lists groups, most recently being responsible for delivering two stages of an inner-city masterplan worth $500m.

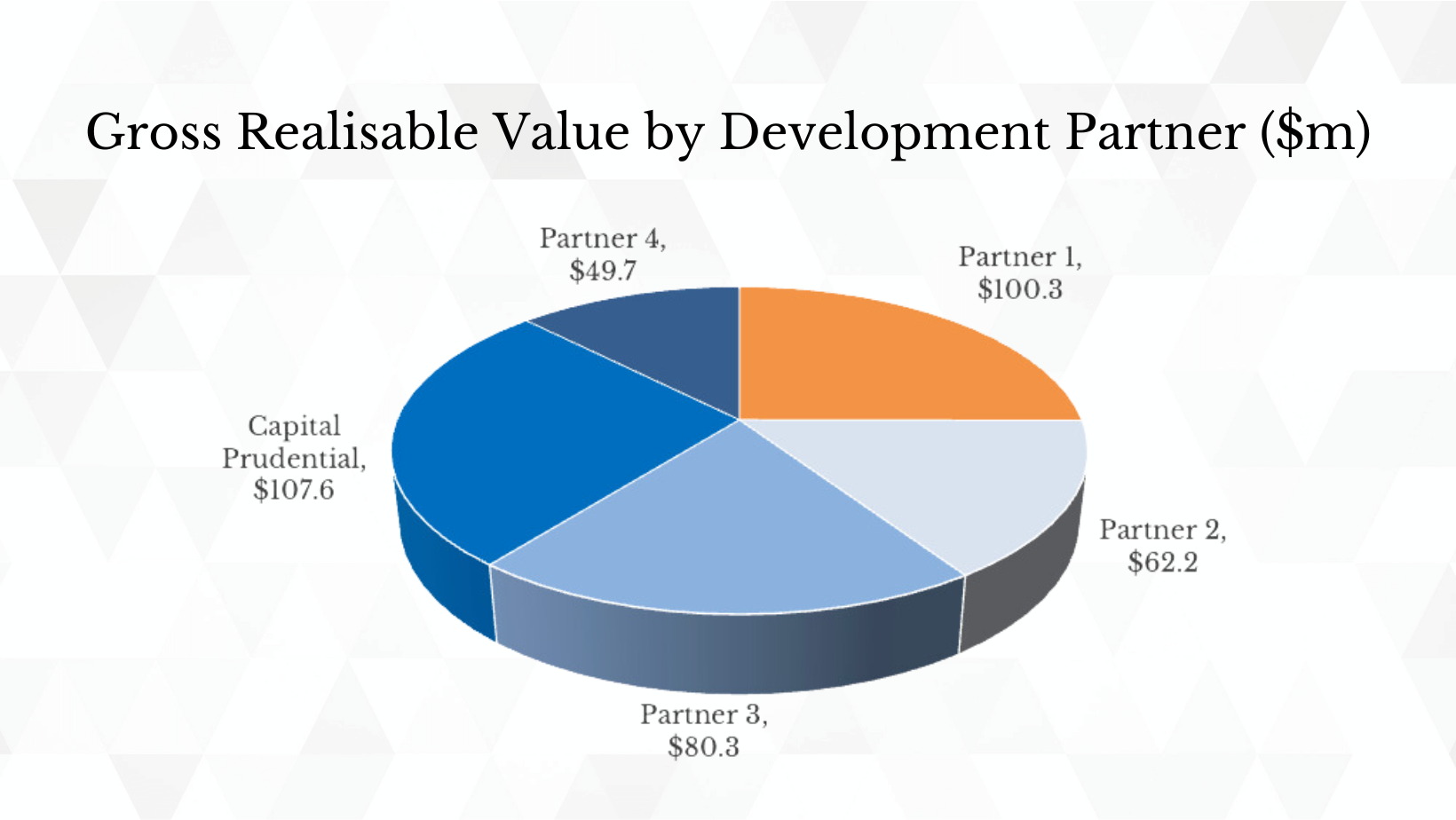

The graphs below illustrate the diversification of the property development assets wholly or majority owned by the Capital Prudential Diversified Development Fund as at 30 June 2024.

This quarter, we were excited to announce that our new retail offering, the Capital Prudential Real Estate Income Opportunity Fund and its wholesale counterpart, the Capital Prudential Wholesale Real Estate Income Opportunity Fund received Favourable 3.75 Star Ratings from SQM Research.2

Our innovative new investment opportunities are now open to wholesale investors and financial advisors via DASH and Hub24 investment platforms.2

Please contact us to obtain copies of the SQM research reports and explore the suitability of these funds for your clients.

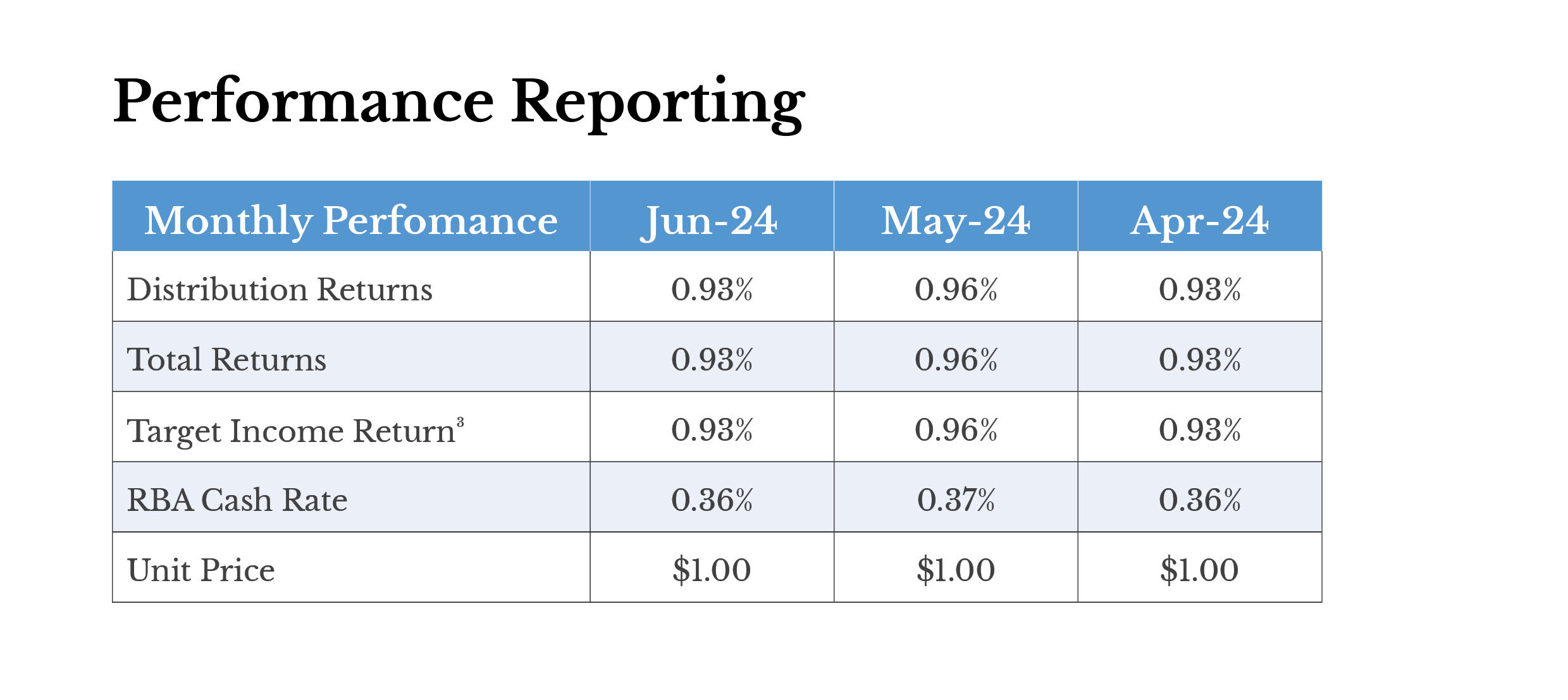

3 Total Returns shown have been calculated using exit prices after taking into account all of fund ongoing fees. No allowance has been made for taxation. Past performance is not indicative of future performance.

DISCLAIMERS: This information has been prepared and issued by Capital Prudential Funds Management Pty Ltd (ABN 83 636 279 082/AFSL 524725) (CPFM) and is intended for use only by wholesale clients pursuant to section 761G(7) or 761GA of the Corporations Act 2001 (Cth). This information is not intended for any person who is a retail client within the meaning of section 761G or 761GA of the Corporations Act 2001 (Cth).

Capital Prudential Diversified Development Fund Pty Ltd ACN 636 282 219 (CPDDF) is the trustee of, and issuer of securities in, the Capital Prudential Diversified Development Fund. The Trust Company (RE Services) Limited ACN 003 278 831, AFSL 235 150 (TTCRESL) is the trustee and issuer of units in the Capital Prudential Real Estate Master Trust. Perpetual Trust Services Limited (ACN 000 142049; AFSL 236 648) (PTSL) is the responsible entity and the issuer of units in the Capital Prudential Retail Real Estate Master Trust. Capital Prudential Manager Pty Ltd ACN 660 087 847 (authorised representative of CPFM) (Investment Manager) is the investment manager of the Capital Prudential Real Estate Master Trust and Capital Prudential Retail Real Estate Master Trust.

This information is general only and is not personal advice. It has been prepared without taking into account your objectives, financial situation or needs. If you require financial advice that takes into account your personal objectives, financial situation or needs, consult your financial adviser. You should consider the relevant Information Memorandum, Product Disclosure Statement and Target Market Determination available by visiting our website https://capitalprudential.com.au/, prior to making any investment decisions.

Neither the Investment Manager, CPDDF, CPFM, TTCRESL, PTSL, their employees or directors, or any of their related parties (including Perpetual Limited ABN 86 000 431 827 and its subsidiaries) provide any warranty of accuracy, completeness or reliability in relation to the information contained herein or accept any liability to any person who relies on it.

Any opinions, forecasts, estimates or projections reflect judgments of the Investment Manager as at the date of this publication and are subject to change without notice. Rates of return cannot be guaranteed and any forecasts, estimates or projections as to future returns should not be relied on, as they are based on assumptions which may or may not ultimately be correct. Actual returns could differ significantly from any forecasts, estimates or projections provided. Past performance is not a reliable indicator of future performance.

This information is current only as at the date indicated and may be superseded by subsequent market events or for other reasons. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. All investments contain risk and may lose value.

¹ The interest rates for a particular offer may differ from the interest rate for any Secured Income Notes previously or subsequently offered and issued. The interest rate for each Secured Income Note will be the rate notified in writing when offered to the Investor prior to their investment.

² The rating contained in this document is issued by SQM Research Pty Ltd ABN 93 122 592 036 AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.

³ This is a target only, the Fund may not achieve this return.